Online bookseller Amazon.com Inc. is warning a federal judge that Internet search leader Google Inc. will be able to gouge consumers and stifle competition if it wins court approval to add millions more titles to its already vast digital library.

The harsh critique of Google’s 10-month-old settlement with U.S. authors and publishers emerged this week in a 41-page brief that Amazon filed in an attempt to persuade U.S. District Judge Denny Chin to block the agreement from taking effect.

A flurry of filings opposing and supporting the class-action settlement is expected by Friday — the deadline for most briefs in the case. At least two other Google rivals, Microsoft Corp. and Yahoo Inc., are expected weigh in with their opposition by then.

Microsoft, Yahoo and Amazon are all part of a group called the Open Book Alliance, formed last month to rally opposition to the Google book settlement. Other participants include the Internet Archive, the New York Library Association and the American Society of Journalists and Authors. The Science Fiction and Fantasy Writers of America, representing about 1,500 authors, on Wednesday became the latest group to join the alliance.

The U.S. Justice Department, which is taking a look at Google’s book deal, has until Sept. 18 to share its thoughts on the case. That filing may provide a better indication whether Justice believes Google’s deal with authors and publishers would violate U.S. laws set up to prevent predatory pricing and promote competition.

Amazon left little doubt where it stands. Its brief brands the provisions of Google’s settlement as "a high-tech form of the backroom agreements that are the stuff of antitrust nightmares."

Although not all the critics have been as strident as Amazon, opposition has been mounting to Google’s plans to create a registry that will sell digital copies of copyright-protected books on behalf of U.S. authors and publishers unless they withdraw from a class-action settlement. Even the German government expressed its opposition to the settlement earlier this week, even though the agreement only covers U.S. copyrights.

Google is downplaying the objections of Amazon, as well as the anticipated protests from Microsoft and Yahoo, as potshots from frightened rivals.

"The Google books settlement is injecting more competition into the digital books space, so it’s understandable why our competitors might fight hard to prevent more competition," Google spokesman Gabriel Stricker said.

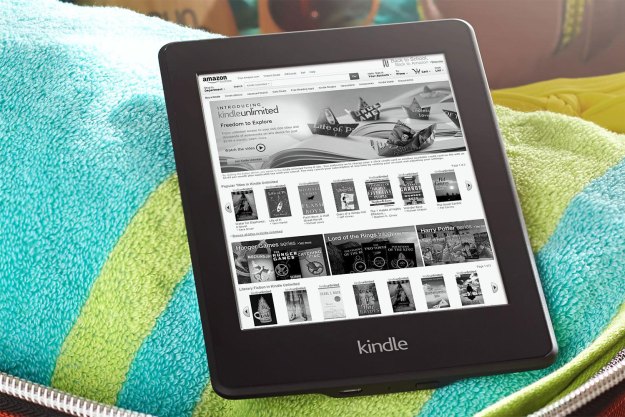

Seattle-based Amazon not only sells books, both in print and digital form, but also is trying to create a new distribution channel with its electronic reader, the Kindle.

The Authors Guild, one of the parties that reached the settlement with Google, thinks Amazon is opposing the settlement because it wants the Kindle be the primary method for buying and reading digital books. "Amazon apparently fears Google could upend its plans," said Paul Aiken, the guild’s executive director.

Google would turn over most of the revenue from its digital book sales to the authors and publishers, just one of the many benefits that the Mountain View-based company is touting. What’s more important, Google contends, is that millions of out-of-print books and other works collecting dust on library shelves would be more accessible if they are stored in its digital library.

More than 10 million books already have been scanned into Google’s electronic index since 2004. The settlement would clear the legal hurdles that have been preventing Google from stockpiling even more digital books to show and possibly sell.

While the concept of a library accessible around the clock from anywhere with an Internet connection has plenty of supporters, opponents cite concerns over how much control Google would be able to exert over pricing and how much information the company intends to collect about the books that people are reading.

Even some proponents of the settlement are telling Chin that he probably needs to address the monopoly concerns and privacy issues raised by the deal.

"This is a pivotal moment in the history of access to recorded information, not unlike the introduction of moveable type or the birth of the Internet," Susan Benton, president of the Urban Libraries Council, wrote in an Aug. 19 letter to Chin.

A court hearing on the settlement is scheduled in New York on Oct. 7.

Many of worries about the book settlement appear driven by the market power that Google has already gained while running the Internet’s most lucrative advertising system along with the Web’s most popular search engine.

In its brief, Amazon suggested the agreement could pave the way for Google to supplant Amazon as the Internet’s largest book store, too.

Amazon maintains it uses its clout to negotiate lower prices for its customers "by playing one publisher off against another."

If Google’s settlement is approved, Amazon believes it will lose negotiating leverage because prices will be set through the central registry that is supposed to be created. Authors and publishers joining the registry can either name their own prices or depend on a Google formula that the company says will generate the most sales. Amazon derided the registry’s pricing rules as "highly suspect, if not per se illegal."

"The use of collective pricing by a single organization without any checks or balances presents a significant danger that consumers will be overcharged," Amazon warned.

What’s more, Amazon contends the settlement will give Google the right to make digital copies of a huge stack of books that won’t be available to any other online seller or electronic subscription service. In particular, Amazon and other critics are focused on a part of the settlement that will enable Google to scan millions of "orphan works" — out-of-print books that are still protected by copyright but the whereabouts of the writers are unknown.

Google maintains those concerns are unfounded because the settlement is nonexclusive, but Amazon and other opponents say it would be too expensive and time-consuming for potential rivals to secure the digital rights to orphan works.

"Google’s ability to offer and sell far more titles than Amazon and other booksellers will make Google’s Web site the destination of choice for persons desiring to view or purchase books over the Internet," Amazon said. "Google will certainly find a way to use that economic advantage to make consumers pay more."

Editors' Recommendations

- Amazon started its Black Friday deals early, but should you shop them?

- Google Nest Hub vs. Amazon Echo Show: Which Cyber Monday deal is better?

- Amazon locks down its Black Friday deals for Yale Smart Locks

- Amazon Echo vs. Google Home: Which Prime Day deal is better?

- Amazon Show 5 vs. Google Nest Hub: Which Prime Day deal is better?