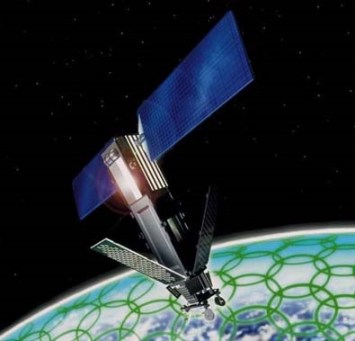

Satellite-based phone services has always been one of those seemingly-great ideas that never really took off—although the technology holds out the promise of offering real-time communication from anywhere in the world, there have been several stumbling blocks, not the least of which is the cost of designing, launching, and maintaining a global network of satellites to support the service. Motorola gave the idea a go back in the late 1990s, and spun the business off into its own company, Iridium—but the company racked up billions in losses and declared bankruptcy a little over a decade ago, though the expensive network and service kept operating, buoyed by government, maritime, and military uses, rather than civilians.

Now Iridium looks to be on the verge of a resurgence: GHL Acquisition Corporation, a New York-based venture firm from Greenhill & Co., has come through with a deal to acquire Iridium—and then announced a public stock offering expected to raise at least $160 million. Overall, the acquisition should put over $200 million into Iridium’s pockets, giving it enough capital to work on a planned 2014 upgrade to its satellite network.

Since the bankruptcy, Iridium says it has managed to build its customer base up to almost 350,000 users and had a revenue base of $87 million in the second quarter of 2009. Satellite phone service is still very expensive—usually $1.50 to $1.75 a minute—but that’s worth every penny to people working, say, as first responders, on ships, or in other areas where land lines and cell phone coverage aren’t available.

Editors' Recommendations

- Moto Watch 100 goes official, skips Wear OS for an affordable price tag

- Digital Trends Live: Uber goes public, iPhone XR design leak, and robot butlers