- Home

- Mobile

Mobile

About

Mobile and smartphone news, reviews, and discussion for everything from Android to iPhone and every accessory and app you could ever use.

Is the Oura Ring waterproof?

The Oura Ring is a powerful wearable device, allowing you to track your sleep patterns, wellness, and more. But is it waterproof? It's time to find out.

The most common iPad problems and how to fix them

The Apple iPad is powerful, but it can still run into glitches or issues. Here's our troubleshooting guide on the most common problems and how to fix them.

The most common Skype problems and how to fix them

With videoconferencing and distributed teams more popular than ever before, fixing errors is crucial. Learn more about common Skype issues and their solutions.

Samsung Galaxy S24 vs. Galaxy S22: Do you really need to upgrade?

Are you thinking about upgrading your Samsung Galaxy S22 smartphone to the Galaxy S24? Some upgrades might make it a tempting proposition — or not.

The 6 best tablets for travel in 2024

If you'll be going on a trip, the experience will be even better if you have one of the best tablets for travel. Here are our recommendations on what to buy.

From Our Partners

Presented By AnkerWork

The most common Google Pixel 8 problems and how to fix them

The Google Pixel 8 and 8 Pro are two of Google's best devices in years, but they're not perfect. Here are some of the more common issues (and fixes) for them.

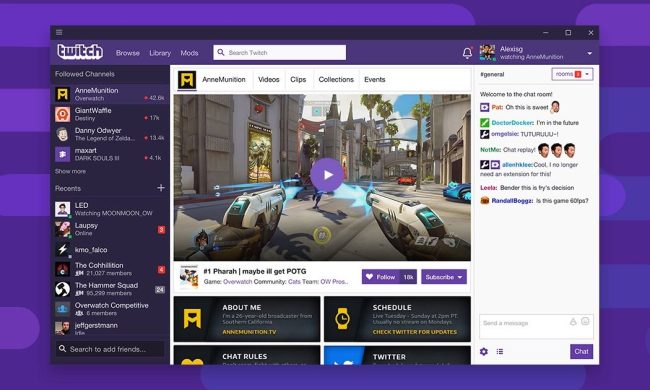

How to cancel a Twitch subscription on desktop or mobile

Is it time to part ways with your Twitch account? Even if you’re only taking a small break from the platform, here’s a guide on how to cancel your subscription.

How to download YouTube videos for offline viewing

Our guide will teach you how to download YouTube videos on PC, iPhone, iPad, Android, and Mac, and educate you on the ethics of doing so.

How to cancel Spotify Premium on any device

Is it time to part ways with your Spotify Premium account? Here’s how to cancel your Spotify subscription on your desktop PC and mobile devices.

8 features I want on the Fitbit Sense 3 (if there is one)

It's unknown whether there will even be a Fitbit Sense 3. If there is, there are a few features we'd like to see on the wearable device.

The 6 best tablets for business in 2024

If you need a tablet for business use, we're here to help. We've picked out all the best tablets for business encompassing different price ranges and needs.

How to get Android apps on a Chromebook

Even if you own an older Chromebook without the Google Play Store built in, you can still add Android apps to your PC. Here’s how.

Apple Music vs. Spotify: Which music streaming service is the best?

Apple Music or Spotify? It’s a question many have asked, and an answer we’re going to explore. Here’s our side by side comparison of both platforms.

This AI gadget let me speak in languages I don’t know or understand

The Timekettle X1 is a gadget dedicated solely to helping you speak and translate different languages. But is it any good? Here's what happened when I used it.

Tidal vs. Spotify: Which music streaming service has the features you need?

Spotify may be king of the streaming music world, but when it comes to audio quality, Tidal offers some big competition. Join us as we compare both platforms.

Does the Oura Ring track steps?

The Oura Ring is one of the most capable smart rings on the market. But can you use it to track your steps?

How to find your lost phone (tips for iPhone and Android)

We show you how to locate your lost or stolen iPhone or Android smartphone using a variety of apps and services, plus tips for finding older phones.

One of Tesla’s biggest competitors is making a phone

Polestar, which has dreams of toppling Tesla one day, is making a gorgeous phone that will live as part of its connected electric car ecosystem.

iPhone 16: news, rumored price, release date, and more

The iPhone 15 is the latest and greatest, but that doesn't mean we can't look ahead to the iPhone 16. Here's what we know so far.

The first Google Pixel 9 Pro hands-on photos are here

The Google Pixel 9 Pro isn't expected to launch for a few months, but that hasn't stopped hands-on photos of the phone from already leaking.

Best Google Pixel deals: Save on Pixel 8, Pixel Buds, and Pixel Watch

Whether you're planning to buy a new smartphone, tablet, wireless earbuds, or smartwatch, we've rounded up the best Google Pixel deals to make shopping easier.

Motorola launched two great Android phones, but one is better

The new Motorola Edge 50 Ultra and Edge 50 Pro smartphones are very similar. But there are reasons one of them costs $300 more. We'll tell you what they are.

I did a OnePlus 12 vs. OnePlus 12R camera test, and there’s a big difference

The OnePlus 12R is a more affordable option than the OnePlus 12, but with slightly lesser specs and no Hasselblad. Does that really matter though? We find out.

Mobile News

Android

Wearables

Apps

Section Editor, Mobile

Joe Maring is the Section Editor for Digital Trends’ Mobile team, leading the site’s coverage for all things smartphones, tablets, and wearables. Since joining the industry in 2012, Joe has reported on the latest mobile tech news, reviewed countless devices, and worked with other writers to help them find the angles that matter.

Need to get in touch? You can reach Joe at jmaring@digitaltrends.com, or find him on Twitter as @JoeMaring1.