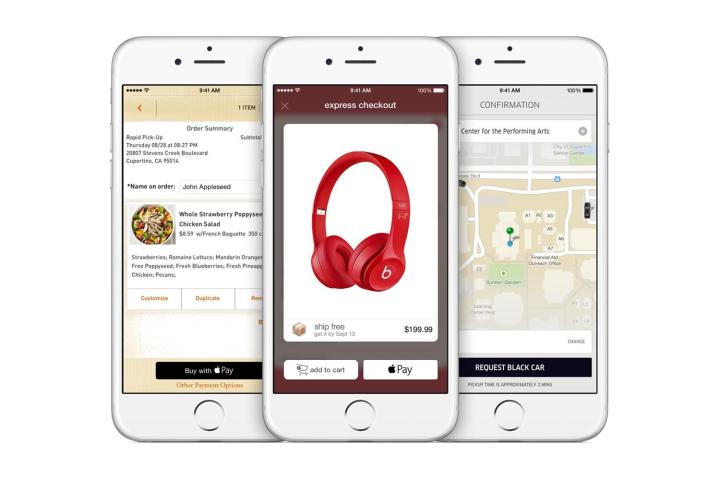

Cook claims that Apple Pay is now the largest mobile payment offering currently available and said that he’s very pleased with its rapid progress. “The early ramp looks fantastic,” he told the Wall Street Journal, adding that he uses it when he shops at Whole Foods. Cook dismissed retailers such as Wal-Mart, CVS, and Rite Aid that refuse to back Apple Pay and expressed confidence that these stores and other skeptic swill soon change their tune, as more customers use Apple Pay.

“You are only relevant as a retailer or merchant if your customers love you,” he said. “It’s the first and only mobile payment system that’s easy, private, and secure.”

Indeed, the tide is changing — retailers will soon be required to upgrade their payment terminals to support EMV cards and the addition of NFC technology should logically follow. Apple’s growing number of partners in the banking and retail industries will certainly help get the word out to customers about mobile payments.

Of course, Apple’s competitors like Google Wallet and PayPal also stand to benefit from Apple Pay’s rise. Although Google has never officially published stats on the number of Wallet users, it’s developer website entices app makers with the promise of access to the “tens of millions of Google Wallet users in the U.S. that can easily purchase your physical goods and services.”

Estimates from the Internet Archive discovered by the Guardian, which checks out download numbers indicates that Google Wallet has been downloaded just under 20 million times. Of course, hitting that number took a very long time. Based on the data, it looks as though Google Wallet hit 1 million downloads in August 2012, almost a year after its launch. It’s unknown how many of these downloaders actually use Google Wallet regularly.

Editors' Recommendations

- How to use Apple Pay with your iPhone, Apple Watch, or Mac

- In 2023, it’s time to finally ditch your real wallet for Apple Pay

- The EU plans to escalate its Apple Pay investigation next year

- U.K. to double Apple Pay and Google Pay contactless payment limit

- Apple will pay you $1 million to find a very specific iPhone bug