On Friday, Bank of America updated its app and added support for Android’s native fingerprint APIs introduced in 6.0 Marshmallow, allowing anyone with a fingerprint-enabled device on Android Marshmallow and higher to log into the app with just a tap of their finger.

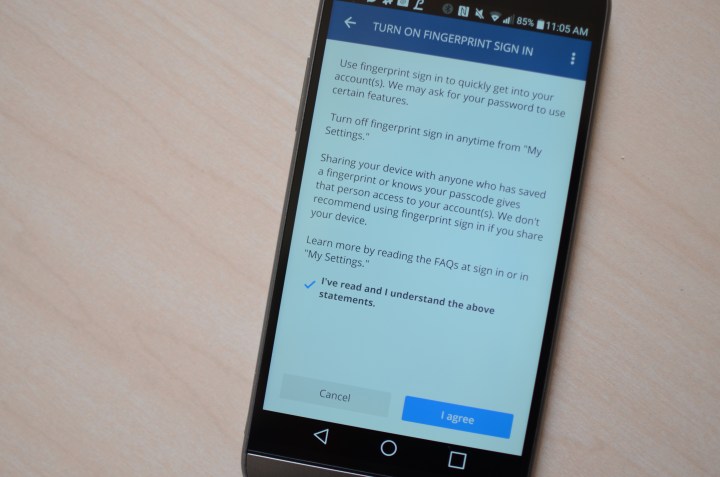

In a bid to keep up with the competition, Chase Bank has also added support for fingerprint sensors on its Android app. When you update the app and log in, you’ll be prompted to agree or decline to use your fingerprint scanner to log into the app. You’ll be able to toggle this in the app’s settings at any time. Some features in the app still require you to input your password, including sending money to people via Chase QuickPay.

Like Bank of America’s app, your phone will need to be running Android 6.0 or higher, and Chase says “due to different implementations of

The Chase app has allowed iOS users to log into via Touch ID since early 2015.

But unfortunately, while Chase supported Google Wallet back when it was Google’s primary payment platform, the bank’s name is still missing from Android Pay’s list of supported institutions. The company is lagging behind such competitors as Bank of America, Capital One, and American Express, who have supported the contact-free payment service for many months now.

These banking apps are a part of a growing number of other services and apps on Android — including the Google Play store, Mint, and Robinhood — that are making use of the fingerprint sensor to add an extra layer of security.

The Chase Bank app update is available to download on the Play Store now.

Editors' Recommendations

- If you have one of these apps on your Android phone, delete it immediately

- Sunbird looks like the iMessage for Android app you’ve been waiting for

- You can finally move your WhatsApp chats from Android to iOS

- You can sideload Android apps on Windows 11, but you probably shouldn’t

- Amazon’s new AR app lets you have fun with all those Prime Day boxes