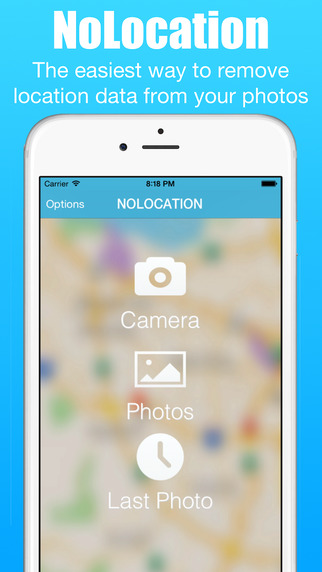

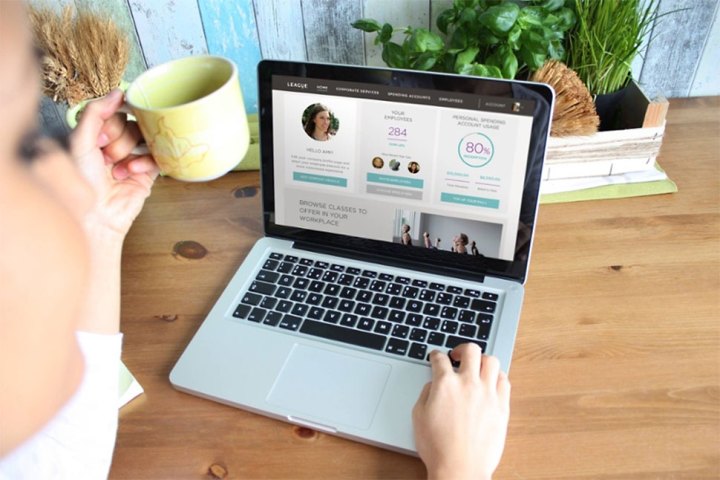

Led by CEO Mike Serbinis, who previously founded and led Kobo, the platform is largely Web and app-based (iOS and Android). It aims to remove paper-based red tape and open more direct lines of communication between the employers, their employees, and the health providers. In effect, League is a marketplace where employees can browse and select the service they feel they need most, spending the money, or “allowance” allocated to them by their employer.

“Having one size to fit everyone is really designed to have people use very little of their benefits.”

Serbinis suggests it is an outright replacement for “your grandfather’s health benefits that don’t really fit today’s employee or consumer.” He argues standard health coverage is limited in choice, particularly in holistic or homeopathic options, like massage or chiropractic treatment. It also costs a lot of money to run that traditional model because of the “laborious process” of submitting paper-based claims, having real people in an adjudication center looking at every claim, and deciding whether to pay out.

“Having one size to fit everyone is really designed to have people use very little of their benefits. It’s claims avoidance versus maximizing your engagement,” says Serbinis. “In our model, there’s no concept of a claim or reimbursement. There’s just a digital wallet in the app, so when it comes to selecting something you’re interested in from the marketplace, that’s it, payment happens automatically. No papers to fill out, nothing for you to do.”

You pick the care you need

Here’s how it works: The digital wallet, or allowance, is at the employer’s discretion as to how much to allocate per employee, but it’s up to the employee on how to best spend that money on their own health and wellness. For example, if acupuncture is a personal favorite, that employee could dip into the allowance and go with a provider in League’s marketplace. No money has to exchange hands because it is all done through the platform, which also has tools for managing appointments.

A key part of this, Serbinis adds, is the transparency. Prices aren’t fixed, they are open, giving providers an impetus to compete, while consumers will know what they’re spending in advance. Meanwhile, employers will be on top of every dollar that goes out through the platform, avoiding any surprise bills at the end of the year. League takes a small administration fee off the top, along with a 2.5 percent transaction fee from providers. Employees or consumers don’t pay anything.

In some instances, League would be an add-on for employers’ existing insurance plan. Still, he says that whether they’re buying corporate wellness or personal spending account features for League, they are largely replacing the insurer.

“The ease of adding or removing somebody from our platform versus on a traditional insurance product is going to make it so that even contractors and short-term employees can have access to the platform,” he says. “Take a construction company, for example, which may have up to 30 contractors working. If many of them have back issues, health insurance may not be feasible for them, so they could get an allowance instead to use for massage, chiropractic, or physiotherapy. They don’t have to take full days off for health reasons.”

The League will expand to more cities and companies

For now, Seattle and Boston are the only U.S. cities where League is operating (Toronto and Vancouver are for Canada), but further expansion to other cities and states is coming soon. Serbinis didn’t reveal where or when, though. Although it’s scalable, the immediate focus has been on small businesses, and more than 100 were added in February alone, including large banks and medium-sized law firms.

In each new geography, the startup recruits the first 50-200 providers, while encouraging word of mouth to get more. Signing up is easy, with a vetting process that takes up to 48 hours to assess insurance, education credentials, licensing or health regulations, and reputation.

“Once they’re in, they’ve got a complete way to run their business, manage their clients, schedule appointments, get payments, issue receipts, handle cancellations, handle reminders, and messaging,” he says. “Even if you don’t want to join the marketplace, but want to use League for your existing clients, there’s a big value proposition there for you.”

Shane Atchison, CEO of Possible, a Seattle-based digital agency, signed his company up for League recently, noting that most of its workforce wasn’t using their benefits, which was also money the company was losing to insurers. With League, the company would only be paying for what employees actually use, and is much easier with less administration for them and the human resources team.

“We’re just getting started but the on-boarding process was effortless, which is something I can’t say about our previous benefits company,” says Atchison. “We know that when people engage in activities that help them get or stay healthy, they just have a better attitude, which can become infectious.”

The immediate impact would be financial, he adds. In addition to requiring fewer admin resources in-house, there is also an upfront savings because Possible would no longer be paying a benefits provider a flat rate for the full workforce. “The app makes it really easy and the fact that we only pay for what people use is better for our bottom line,” he adds.

The tangible impact for employees remains to be seen, though Atchison expects they will be motivated to take advantage because of how the app automates so much of it. Without paperwork and open options, engagement is expected to be high in the coming months.

For Serbinis, higher engagement is necessary in a time where chronic disease is growing and a tiny percentage is spent on prevention.

“Existing plans make it very difficult for consumers to use plans they have, and is a big reason why people don’t take care of themselves when they could,” he says. “You end up seeing less investment in prevention and wellness, so by making it more accessible and transparent, and easy to use through an app, we’re giving people the kind of choice they didn’t have before.”