Location is one of social networking’s hottest trends. It’s been redefining how we use the Internet, putting digital platforms to tangible, real-world use. But let’s face it, location-based services exactly known for saving you money. The entire Foursquare scheme is to elevate customer loyalty, getting users to frequent locations and giving businesses a reason to partner with the site on deals. At its core, it’s a cycle that largely gets users to spend more money.

Location is one of social networking’s hottest trends. It’s been redefining how we use the Internet, putting digital platforms to tangible, real-world use. But let’s face it, location-based services exactly known for saving you money. The entire Foursquare scheme is to elevate customer loyalty, getting users to frequent locations and giving businesses a reason to partner with the site on deals. At its core, it’s a cycle that largely gets users to spend more money.

The likes of Groupon, Yelp, and AirBnb are no different: They all wrap location around e-commerce. It’s not just about where you are — it’s about what you’re going to buy there. So something like Poorsquare was inevitable.

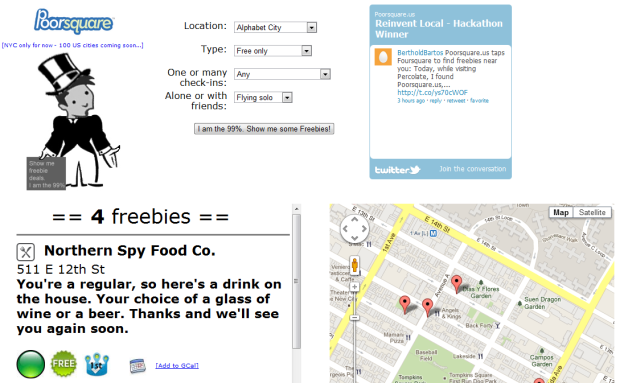

Poorsquare is little more than a Foursquare hack that was created at the Reinventing Local hackathon by Andrew Pinzler and Jeff Novich. Basically, the application is a Foursquare-powered search engine that rifles through the network to find seriously discounted items and freebies in your neighborhood (that is, if your neighborhood is located in New York—the site says 100 new cities are on the way).

You can search Poorsquare by location, type of discount, how many check-ins are required, and if you need to bring friends. If you find yourself alone in Astoria New York, Poorsquare tells us you can get a free small fry at Burger King as well as a free shot at Tantra Lounge in exchange for nothing more than your first-time check-ins.