Earlier this week, Apple unveiled sales for the last three months of 2013, and it sold 51 million iPhones. Reactions across the techoblogosphere were insanely mixed. Some headlines called the sales disappointing, others touted them as record highs, and still more tried to say they were bad because they didn’t meet Wall Street profit expectations (which were 57 million). These sorts of headlines happen almost every three months. However, after watching iPhone sales tightly for several years now, one thing has become clear: the iPhone is peaking.

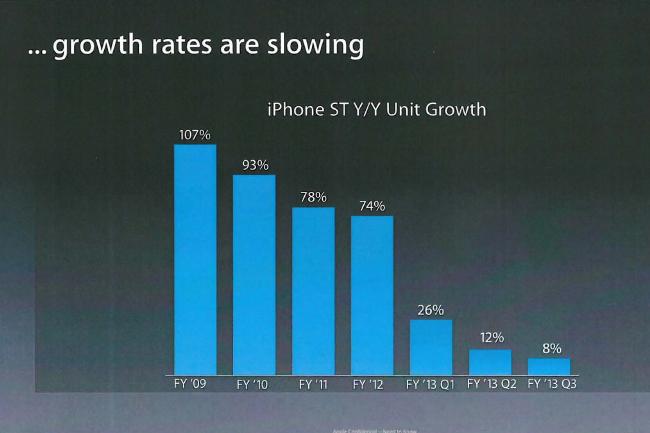

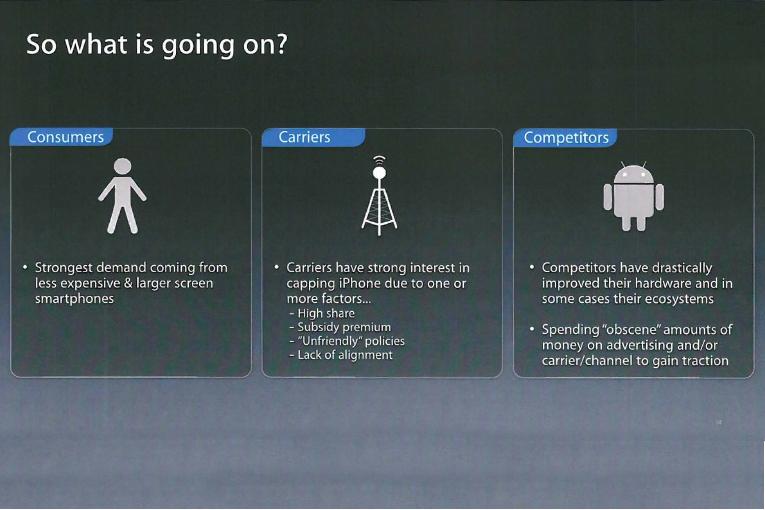

Updated on 4-07-2014 by Jeffrey Van Camp: The latest Samsung vs. Apple trial further validates the opinions expressed in this article. Internal slides from Apple show the company worried about decreasing growth for the iPhone, noticing that all growth is happening with larger phones and cheaper phones. We’ve embedded three of the slides below, courtesy of Recode. Newer rumors about the iPhone 6 also point toward a larger screen, which would be a clear attempt to turn sales around by Apple.

- 1. iPhone’s growth rate (Source: Apple)

- 2. Larger and cheaper phones eating up sales (Source: Apple)

- 3. A summary of iPhone’s challenges (Source: Apple)

Barring some crazy must-have innovation, Apple’s phone seems to have just about reached the number of people it’s going to reach. The rest of the industry — dominated by Android phones by companies like Samsung — shows some signs of slowing, but is taking nowhere near the hit that Apple is. It’s a shame, too. We like the iPhone; it’s a great device. To explore this, we put together some numbers and pretty charts.

The first thing you’ll notice is the pattern here. For the last few years, Apple has launched its new iPhone(s) in September and the last quarter of the year blows up with sales. From January – August, you can see demand trail off until the next model debuts. Part of this is people holding out for the next model. Demand consistently peaks after a new iPhone debuts, as you’d expect.

Looking back at the most recent numbers, Apple sold 51 million iPhones from Q4 (Oct. – Dec.) 2013. That is impressive, but it’s less so when you compare it to the 48 million iPhones Apple sold a year prior. It’s year over year growth for this period was 7 percent, the lowest it’s ever been by a lot. And it’s not an anomaly either. Holiday sales growth of the iPhone has slowed dramatically in the last two years.

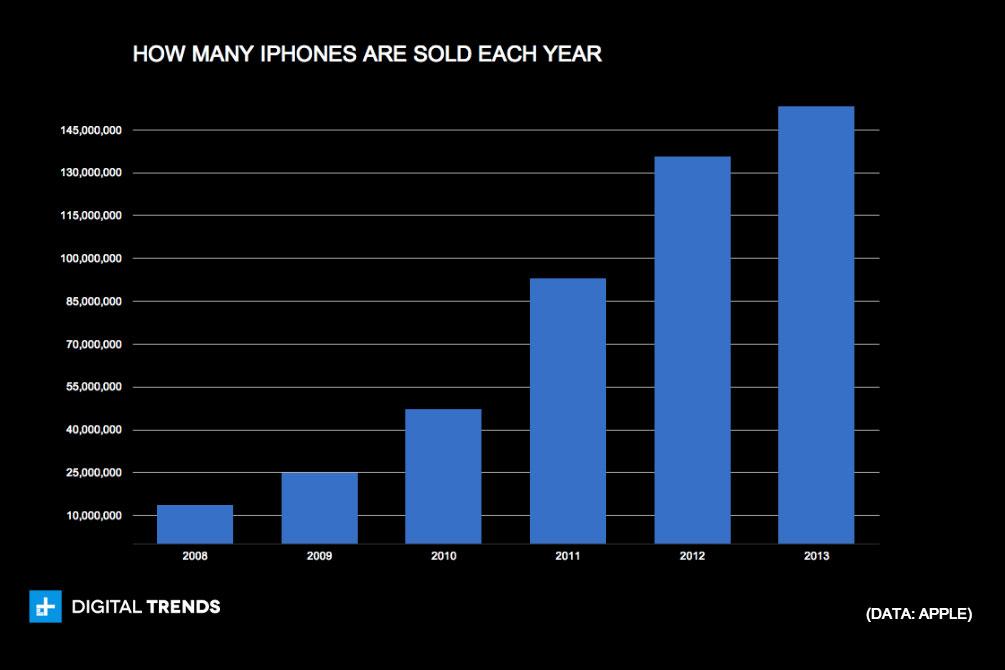

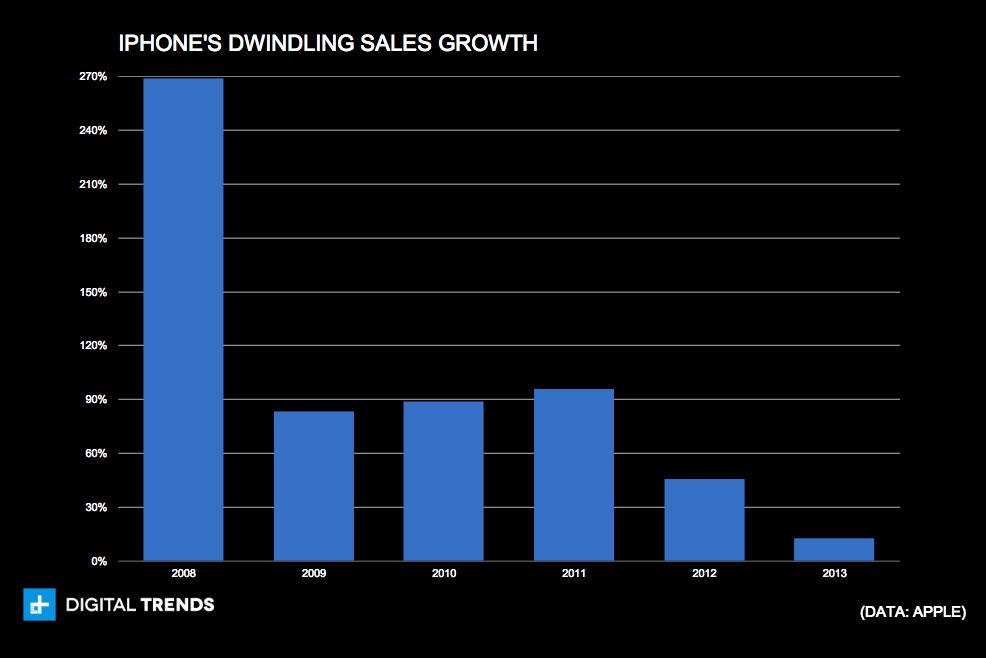

From 2007 to 2011, iPhone sales doubled every holiday season, more or less. A new iPhone meant way more sales, but that’s no longer the case. In 2012 that growth fell by two thirds, and even with two iPhones in 2013, it all fell again by another two thirds. But you wouldn’t realize this by looking at the sales chart. Sales look like the chart on the left. It’s the one with a lot of upward momentum.

- 1. How many iPhones are sold each year

- 2. iPhone’s dwindling sales growth

Look at the chart on the right and you’ll see what you’re really looking at. Dwindling growth each year for the last few.

If you take a step back and look at an entire year of iPhone sales, the pattern is similar. Sales of the iPhone in 2013 reached 153.4 million, or about 13 percent higher than the year before. And 2012’s growth was half that of 2011. And again, before 2011, things just kept doubling for the iPhone.

Why this is happening is not entirely known. There are many likely culprits:

- The growth of Android phone makers like Samsung.

- An explosion of companies who want in on Android smartphones – even PC companies like Lenovo and Acer now make phones.

- An explosion of cheap Android phones that aren’t half bad, lead by devices like the Moto G.

- Growth of larger ‘phablet’ phones that straddle the line between phone and tablet.

- Expansion of sales in developing regions of the world like China, which Apple recently inked a deal with at the end of December.

- Failure of iOS 7, iPhone 5, iPhone 5S, and iPhone 5C to drive as much buzz as previous models.

We assume that more people are buying the flagship iPhone 5S than Apple’s cheaper, plastic, colorful iPhone 5C, but Apple doesn’t provide iPhone sales breakdowns. Either way, this is the first year two iPhones have been released out and it appears appear that the tactic hasn’t done much to boost sales, likely because the 5C is a similar phone without much of a price discount. But without it the iPhone 5S may have performed worse and sales may have decreased. We don’t know.

In the chart below, we’ve compared the yearly sales growth of the iPhone with Samsung. To give perspective, we’ve included the annual percentage of growth for the entire smartphone market.

We don’t have Samsung sales numbers before 2010, but that is when it’s momentum began to skyrocket thanks to the success of its Galaxy brand of phones. Samsung has seen slowing sales growth recently, much like Apple. Samsung’s growth fell to less than 45 percent in 2013 as well. Industry-wide, sales have remained far more stable, growing by about 50 percent annually for the last few years.

Finally, to get a clearer look at how well iPhone (which runs iOS) has sold compared to its rival operating systems competitors – Windows Phone, Android, and BlackBerry – we turn to one last chart.

You can see how Apple’s pattern of sales for the last two years differs from Android, which just keeps growing without fail. It’s effectively become the Windows of mobile and the scapegoat for everyone else’s sales problems. Microsoft’s Windows Phone, on the other hand, continues to grow, but not by much. It sits on a 3.5 percent market share, with sales that are less than a third of the iPhone. BlackBerry, heaven rest its incoming soul, continues to slowly die, selling millions less phones each quarter despite being in a growing industry.

It’s difficult to say how Apple can turn things around, but it’s currently in a pattern of decreasing growth, and as BlackBerry will attest it isn’t long before slow growth becomes no growth and no growth becomes losses. Some suggest that Apple should introduce new types of iPhones in the phablet and super cheap variety; many credible rumors even point toward a big-screen iPhone 6, but these aren’t strategies Apple likes, and are unlikely. Its new deal with China Mobile is a good start, but outside of a new device, like an iWatch, helping propel Apple’s entire product catalog, Samsung imploding, or Apple entering the race to the bottom on pricing, Apple may have a tough time reversing its waning sales growth. (But if you’re listening, Apple, it wouldn’t hurt to improve battery life on the next iPhone.)

What do you think Apple can do to get more people interested in the iPhone and keep up with Google?

(Image courtesy of saiko3p via Shutterstock.com)

Editors' Recommendations

- An Apple insider just revealed how iOS 18’s AI features will work

- iPhone 16: news, rumored price, release date, and more

- iPhone SE 4: news, rumored price, release date, and more

- Here’s how Apple could change your iPhone forever

- There’s a big problem with the iPhone’s Photos app