Black Friday tends to bring out the worst in people. Shoppers trample one another to get the latest iPhone and talking Elmo. They curse at cashiers and elbow one another in the checkout lines, while bellowing, “What’s taking so long?”

Chances are, the answer to that question is the messy checkout process. Digging around in your purse for your wallet and a few spare pennies takes time, as does swiping the card and entering all the info correctly, especially when the cashier and shopper are under Black Friday stress.

It hasn’t happened yet, but the wallet could go extinct.

But it doesn’t have to be this way. Thanks to Apple Pay and Google Wallet, the world is finally paying attention to mobile payments. Although many big-name stores already have point of sale terminals (POS) that accept Near-Field Communications payments (NFC), such as Apple Pay and Google Wallet, a number of small businesses will get them soon, too, thanks to companies like Square and Clover.

The retail experience, as we know it has begun to change forever. So what will our brave new world look like? We spoke with Clover CEO and founder Leonard Speiser about the company’s new tablet-like sales terminal, app purchases, and tap-to-pay systems to get a better idea.

The revolution is coming

Clover, which is owned by First Data, distributes point of sale terminals through banks to small and medium-sized businesses across the country, and its lineup is undergoing a massive change.

Its Clover Station and new Clover Mobile terminals support most kinds of payments, including the latest and greatest forms of mobile payments, including QR codes, Bluetooth, NFC, Chip and PIN, and standard card swipes. It is, in a word, “future-proof,” though Speiser doesn’t like the term.

“I feel like the term future-proof is like putting up a shield from the future so it can’t hurt you or touch you,” he told Digital Trends. “I feel like we need to future enable people with new technology.”

Speiser says that most merchants will completely change their point-of-sales terminals in 2015, when Chip and PIN becomes the standard for payments, thanks to a new law. Since they’ll have to update the terminals anyway, it’s likely that most merchants will add NFC, which is by far the most popular mobile payment technology. Once that happens, the retail experience will begin its first big change in a good long while, and Speiser is hoping to ride that wave of change with a new line of tablet terminals.

The cash register of the future

Even though Clover is owned by First Data, Speiser likes to maintain a startup mentality at the company. Like Square, Groupon, and others, Clover aims to push boundaries and build cash registers for the future. Its first POS is a larger, stationary system called Clover Station, but its second payment terminal is something a lot smaller.

“Most people just think of tap-to-pay, but we made the world’s first Apple Pay bar.”

Clover Mobile is the kind of cash register you’d want to use in 2014. It’s a 7-inch Android tablet with a credit card reader, Chip and PIN, barcode and QR code scanner, and NFC built in. It has a handle fused on the back to make it easy to prop up on a table or carry around with you while you scan inventory and check your sales. The tablet lasts a full business day on a single charge and pops into a charging dock when you’re using it.

It has the portability of Square’s card reader, but the full functionality of a stationary register. Clover’s mobile terminal even supports more forms of mobile payments than Square, including NFC-based transactions from Apple Pay and Google Wallet

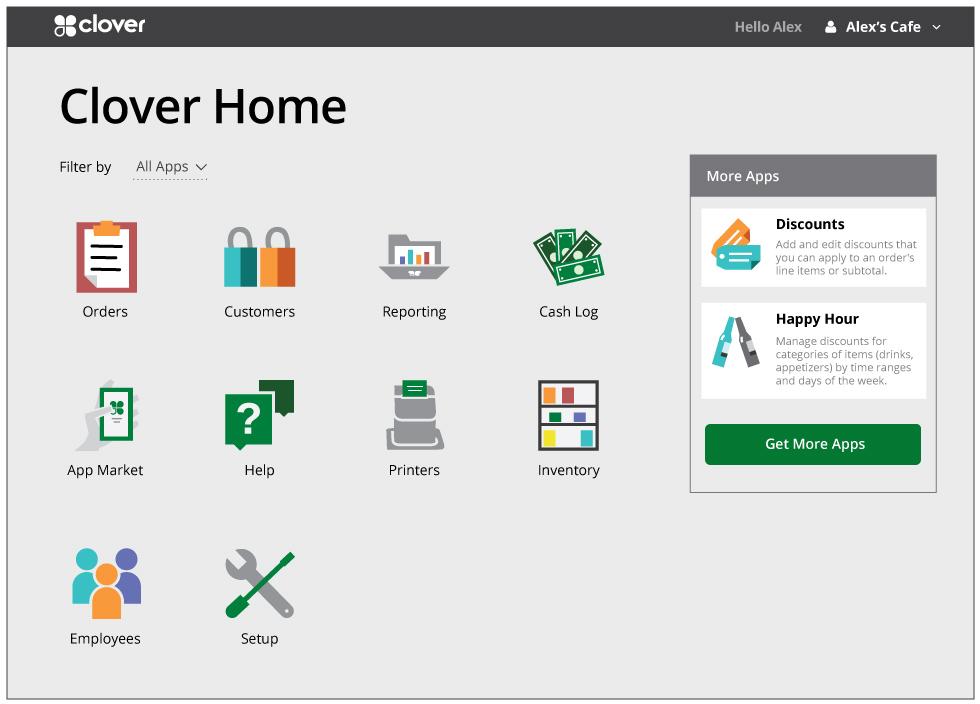

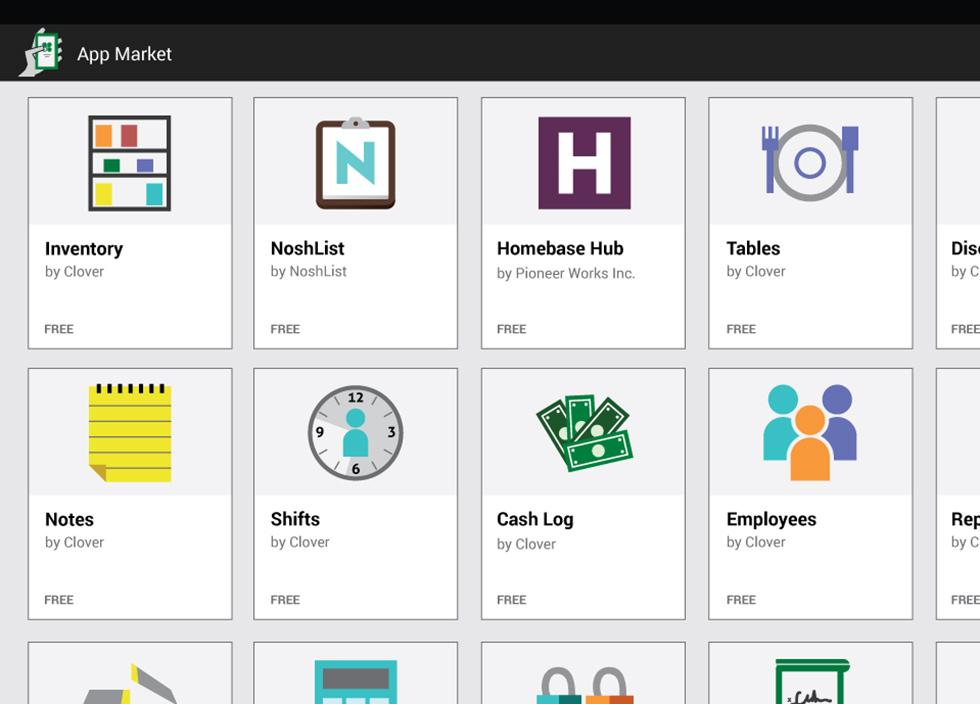

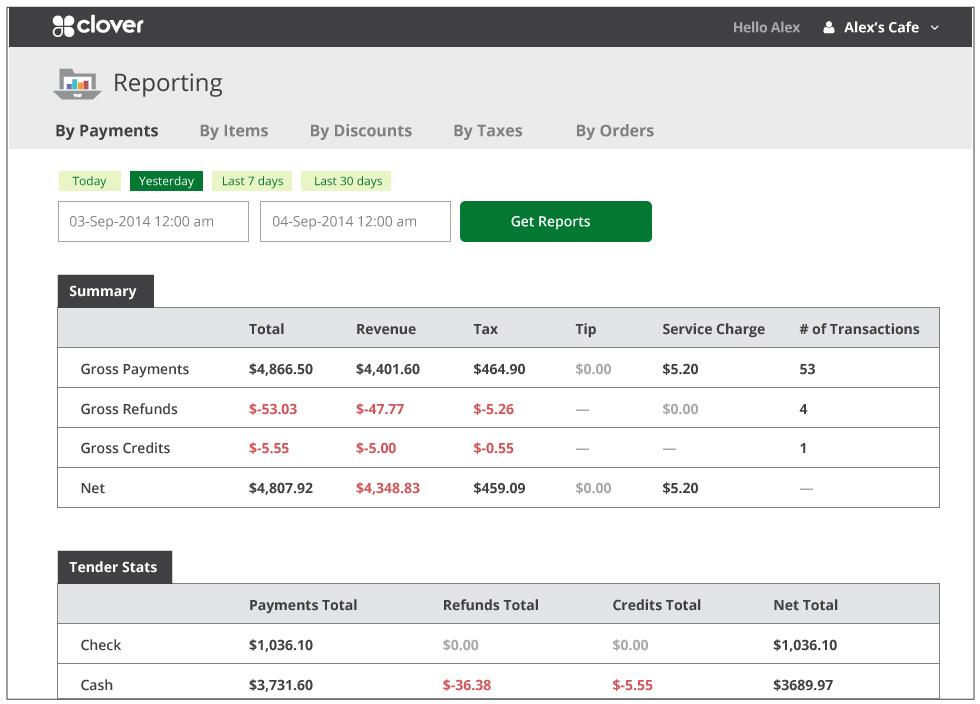

Clover has its own app store, too, where developers can create apps for business owners. The company creates standard apps that help business owners keep track of inventory, employee hours, vacation time, payroll, and other metrics. Many of the apps can also be customized or changed to suit each user’s needs, and businesses can create apps for customers to use in their stores, restaurants, and bars.

Perhaps the best part of Clover Mobile is its price: The developer kit costs just $350, or about the same price as regular tablet. However, unlike its competitors, Clover doesn’t sell its POS terminals to businesses directly. First Data coordinates the sales to business owners through Bank of America, Citibank, PNC, Wells Fargo, and 3,000 other banks in the U.S.

So far, Clover has sold 30,000 of POS terminals to businesses, and claims it will sell more than 10x this before the law change in 2015.

Paying with apps and taps

Assuming that everything goes according to plan, you may never have to swipe a credit card again. In the near future, you’ll be able to tap Chip and PIN cards against the terminal to pay, or tap-to-pay with services like Apple Pay, Google Wallet, and PayPal.

Assuming that everything goes according to plan, you may never have to swipe a credit card ever again.

As fun as tapping to pay is, that’s not the most exciting part, either. Just like you would with an Uber car, you’ll be able to buy goods and services with a tap in an app on your phone. Thanks to Apple Pay, this is already possible. iPhone users can buy things from Target, Staples, Panera, and many other places, with nothing more than an app, Apple Pay, and their fingerprint.

“Most people just think of tap-to-pay, but we made the world’s first Apple Pay bar,” Speiser said, referring to an app (available for iOS) that was designed for the company’s Clover platform at a California bar and restaurant called the Bierhaus.

Essentially, bar patrons walk into the Bierhaus, sit down at a table, and order everything on their phones. You enter your order, table number, and tip, before paying for your purchase with Apple Pay. The server then brings your food and drinks, and you’re done.

The app speeds up the entire process. You don’t have to wait for your server, explain your order, hand over your credit card, open a tab, close it, and wait for your server to return with the final bill.

In places like restaurants and bars where traditional payment methods and tap-to-pay aren’t practical or efficient, using the venue’s app is often the perfect solution. It eliminates friction between you and your server, lessens wait times, and ensures that your order is always correct.

The only downside of the app solution is that you might end up with a lot of apps on your phone. That is, unless someone like OpenTable comes along to aggregate all the restaurants and bars into one app. (Someone please work on this.)

When will it happen?

It won’t happen for a while, but the wallet really could go extinct. It’s clear that customers don’t like having to deal with tons of physical credit cards and reward cards. Systems like Apple Pay and Google Wallet could very well eliminate the need for all these cards, if retailers open their minds to the future.

Clover’s new small, mobile POS terminal, and others like it, are true game changers. The days of huge, clunky cash registers are ending. Next time you go out to eat, the only hassle you may have to deal with is the food itself.

Editors' Recommendations

- How to add your ID or driver’s license to Google Wallet

- PayPal vs. Google Pay vs. Venmo vs. Cash App vs. Apple Pay Cash

- Get 3% Daily Cash on Apple Card for any T-Mobile store purchase