Intel always competes against AMD, both make some of the best processors, and the sky is blue — what else is new? Well, it turns out that one of those statements might not be as true as it was just last week. Intel CEO Pat Gelsinger revealed that Intel’s own fabs are open to making chips for some of the biggest companies in tech, and that even includes its long-standing rival AMD.

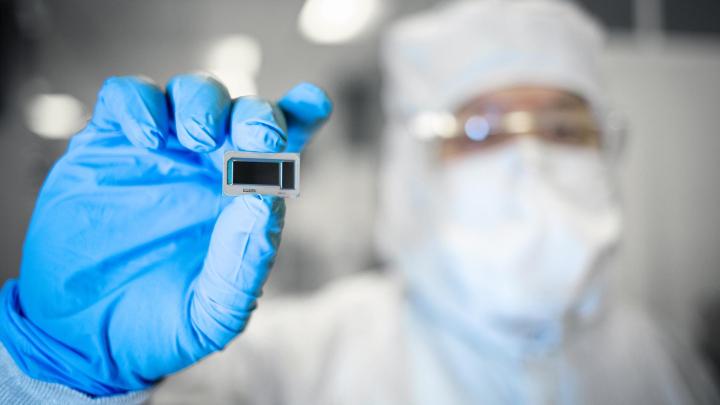

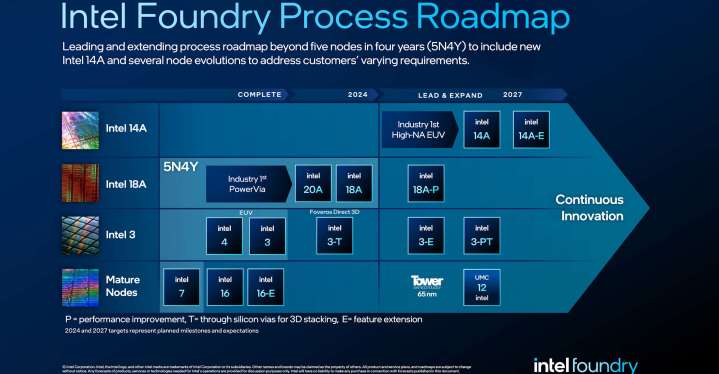

Gelsinger spoke during the first Intel Foundry Direct Connect in San Jose, California, about the operations of its new fab, which Intel itself refers to as a “more sustainable system foundry business designed for the AI era.” Intel has big plans for its foundry, with a goal to beat its biggest rival TSMC in advanced chip manufacturing by 2025. The company reportedly hopes to be making the world’s fastest chips already this year with its Intel 18A manufacturing technology. Beyond that, Intel hopes to widen the gap with its new 14A technology in 2026.

Microsoft is among Intel’s first big clients, with plans to manufacture a chip based on Intel’s 18A process, and Microsoft’s CEO Satya Nadella was among the speakers at the event. Intel historically made chips only for its own purposes, but it appears that the Intel Foundry opens up a new chapter for the company — one where previous rivalries no longer matter.

If Intel is truly willing to manufacture chips for its direct competitors, where does that leave its product teams? Paul Alcorn of Tom’s Hardware asked Gelsinger what would happen in a situation where Intel’s own product teams would have to compete against rivals that use Intel’s chips, and Gelsinger made it pretty clear that Intel just wants to build chips, period.

“There are Intel products and Intel foundry,” said Gelsinger. “There’s a clear line between those, and as I said on the last earnings call, we’ll have set up a separate legal entity for Intel foundry this year. […] And the foundry team’s objective is simple: Fill. The. Fabs. Deliver to the broadest set of customers on the planet.”

Intel’s hope to sell to a broad set of customers appears to already be becoming a reality. According to Reuters, Intel now expects $15 billion worth of orders in its foundry, up from the initial $10 billion estimate that it previously presented to its investors. And some of those customers could be really big names.

“We hope that that includes Jensen [Huang of Nvidia], Christiano [Amon of Qualcomm], and Sundar [Pichai of Google], and you heard today it includes Satya [Microsoft], and I even hope that includes Lisa (Su of AMD) going forward,” Gelsinger elaborated, talking about the way Intel wants to keep the fabs filled to the brim. “I mean, we want to be the foundry for the world, and if we’re going to be the Western foundry at scale, we can’t be discriminating about who’s participating in that.”

Intel also referred to ARM as its most important customer, so it’s not just the rivalry with AMD that is seemingly put to rest. Intel really does appear to treat the Intel Foundry as a separate entity. But will AMD, which currently relies on TSMC, really turn to Intel for help in making its chips? We’ll have to wait and see, but one thing is certain — this is one rivalry that we never expected to end, and the outcome of this might surprise us all.

Editors' Recommendations

- All of the exciting new GPUs still coming in 2024

- Everything you need to know about buying a GPU in 2024

- How 8GB VRAM GPUs could be made viable again

- Nice try, Intel, but AMD 3D V-Cache chips still win

- Intel just launched the ‘world’s fastest’ CPU