Money makes the world go ’round. Whether you owe a friend for drinks or you need to send rent money to your roommate, the easier it is to transfer money to friends and family, the better.

With modern technology, there are plenty of great options for sending money to others. Sure, PayPal may be the best-known of these services, but it’s certainly not the only one. Google reorganized Android Pay and Google Wallet into a single service called Google Pay. Then there’s Venmo, which has skyrocketed in popularity, and Cash App, built by payment company Square. Perhaps it was a little late to the game, but we can’t forget about Apple Pay Cash.

Which of these payment services should you use to send money to your friends, family, and others? We put them side by side to find the best.

| PayPal | Google Pay | Venmo | Cash App |

Apple Pay Cash | |

| Compatibility | Android, iOS, Web | Android, iOS, Web | Android, iOS, Web | Android, iOS, Web | iOS |

| Payment methods | Credit, debit, bank transfer | Credit, debit, bank transfer | Credit, debit, bank transfer | Credit, debit | Credit, debit |

| Credit fee | 2.9% + $0.30 | Up to 4% | 3% | 3% | 3% |

| Debit fee | 2.9% + $0.30 | 1.5% or $0.31 (whichever is greater) | Free (1% for instant transfers) | Free (1.5% for instant transfers, min $0.25) | Free (1% for instant transfers, min $0.25) |

| Bank transfer fee | Free (1% for instant transfers) | Free | Free | Free | Free |

| Withdrawal speed | Around 1-3 business days | Around 1-3 business days | Usually 1 business day | Around 1-2 business days | Around 1-3 business days |

| Transfer limits | $10,000 | $5,000 | $5,000 | $7,500 | $10,000 |

| Special features | PayPal.me shareable links | Integration with other Google services | Quick transfers to banks | No need to set up an account | Automatically available in iOS |

PayPal

As previously mentioned, PayPal is perhaps the best known of these services — though that has been changing in recent years. PayPal has long been the go-to for online shopping, and the fact that it can be used to transfer money between friends is simply a bonus.

PayPal’s interface is extremely easy to use, largely thanks to a major redesign. Simply open up your PayPal account, press the “send money” button, and follow the instructions — it only takes a few seconds to send money. The PayPal.me initiative has made sending money even easier. If you have your friend’s PayPal.me link, simply follow the link and enter how much you want to pay them. There are no fees to send or receive money from friends and family in the U.S — but if you’re sending or receiving payments from another country, fees apply.

What PayPal has going against it, however, isn’t related to its ease of use. Out of the five services, PayPal is the most expensive, if you don’t want to connect the service to your bank account (or for sending or receiving international payments). Now, we would highly recommend connecting it to your bank account anyway, as it makes things a lot easier if you happen to lose your debit or credit card or when you get a new one. However, if you choose not to, PayPal will be one of the most expensive services for you. Not only does it charge a 2.9% fee for money sent from a debit or credit card, but it also charges an extra 30 cents on top of that. If you’re planning on sending or receiving money internationally, fees are even steeper.

PayPal also charges a 1% fee for instant withdrawals to your bank account or card.

One advantage is that PayPal allows the largest transactions of the bunch, tied with Apple Pay Cash and Google Pay. Using PayPal, you can transfer up to a hefty $10,000. Most people won’t need that — but it’s nice to have in case you do.

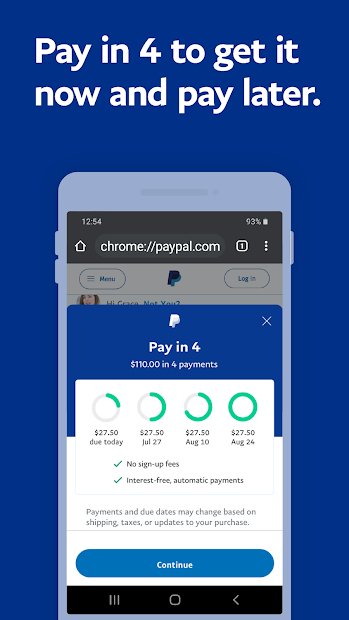

You can pay for goods in stores by scanning the app’s QR code to pay using PayPal, or use the Pay Later feature to spread the cost of purchases by paying a down payment today and the remainder in three installments.

Like some of the other services on our list, PayPal won’t transfer money directly to your bank unless you manually do it. Instead, money will sit in your PayPal account and can be used for purchases or sent to your bank, as you see fit. Also, PayPal Credit users might prefer PayPal, as it eliminates the need to have any extra accounts.

Google Pay

Google Pay is one of the cheapest services on the list, although with the launch of the new Google Pay app, fees have changed slightly. You can no longer use your credit card to send money to friends and family — instead, you can use your debit card for which Google Pay charges a fee of $0.31 or 1.5% of the total transaction (whichever is greater). There are no fees to transfer funds from your bank account to your Google Pay balance and vice versa. The maximum amount per transaction has been reduced to $5,000, with a maximum withdrawal amount per rolling seven-day period of $20,000. The maximum amount you can pay friends and family per rolling seven-day period is also $5,000. The new Google Pay app also caps the total amount of withdrawals you can make at 30 withdrawals every seven days, and you can only hold up to $25,000 at any one time in your Google Pay balance.

Of course, you can still use your credit card to make contactless payments in stores using Google Pay, but only if you’re on

There are some other changes to Google Pay too, including the way it integrates with other Google services — which used to be what really set Google Pay apart from other payment services. Since July 2020, you can no longer send, request, or receive money through Gmail,

Sending money via the new Google Pay app is as simple as tapping Pay Friend or Group, searching for your contact by name, email, phone, or QR code, entering the amount and payment method, and tapping Pay. If you try to send money to somebody who’s not in your contacts list, the app will alert you. You can also use your fingerprint sensor or Face ID to unlock the app. Transferring money into your bank account could take up to three days, but it’s usually instant when you’re sending it to a debit card.

The app can also store loyalty or gift cards or even flight and concert tickets.

Venmo

Venmo has grown a lot more popular over the past few years, becoming the preferred way for many people to transfer cash to their friends. In fact, Venmo has become a verb — “Venmo me!” After creating your account, you’ll be asked to add people to your friends list, which makes it easier to transfer money the next time you need to do so.

There are a few things to keep in mind when using Venmo, however. For example, the team behind it has tried to make the service highly social, which may frustrate some. When you send money, you’ll have the option to make the transaction public, and while you most likely don’t want or need to do this, you’ll have to be careful to not accidentally select the wrong option.

Like other services, when someone sends you money, it sits in your Venmo account — it can be sent to others or transferred to your bank account by “checking out.” It’s free to use Venmo with a debit card. It will still cost you 3% to use a credit card, but if you’re not too fond of linking a service to your bank account, it might be nice for you to not have to pay a fee for each transaction. Not only that, but Venmo says that money will be transferred to your bank account within one business day, which is pretty quick — or you can pay a 1% fee (max $10) for an instant transfer. Venmo recently added an option to instantly send money to your debit card for 25 cents; there’s still a free option, but it’s not as fast.

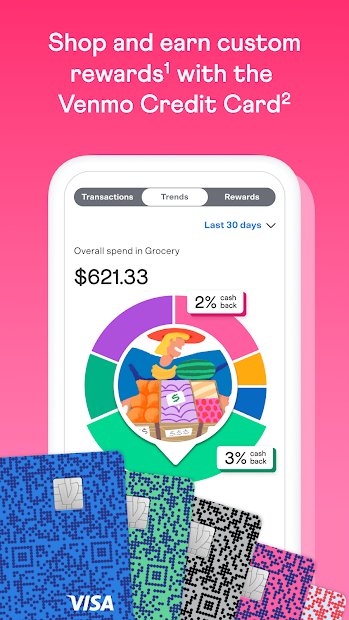

Venmo also offers a credit card that gives you up to 3% cashback on your purchases and a debit card which offers a similar cashback feature. You can even scan physical checks directly into your Venmo account with the Cash A Check feature, and be paid your salary via Direct Deposit.

Venmo is obviously meant to be used for everyday transactions, and as such, it sets a weekly limit of just under $5,000. It’s still a lot of money, sure, but you won’t be using Venmo to send a huge amount of cash like Apple Pay Cash or PayPal.

Cash App

Next up on our list is Cash App, built by Square, which is perhaps best known for its point-of-sale systems for the iPad and iPhone. At first glance, you might have trouble seeing why you would want to opt for Cash App over other services, but it does have one unique selling point — you don’t have to set up an account to use it. However, you will need to verify your identity to lift the spending limit of $1,000 within any 30-day period. On the plus side, Cash App charges no fees to send or receive payments in the U.S. or abroad — although the current exchange rate applies for international payments. You’ll pay a 3% fee for all credit card payments.

You can also order a debit card with Cash App. The virtual card can be used for online purchases — iOS users can link the card to Apple Pay — and you’ll also receive a physical card that you can use to make in-store payments.

To request cash, select a name from your contact list, or enter their email address or phone number. Enter what the money is for, and enter the amount. You can then select which speed of deposit you’d like. Cash App offers two speeds for deposits — Standard Deposits to your bank account and Instant Deposits to your debit card. Standard Deposits are free and should hit your account in one to three business days. Instant Deposits should arrive to your card instantly, but there’s a 1.5% fee, with a minimum fee of 25 cents. Once the request is received, both parties will need to confirm their banking information, and the transfer will go through.

Apple Pay Cash

Unlike the other services on this list, you may already have Apple Pay Cash, which rolled out as part of iOS 11.2, if you have an iPhone. That means you don’t need to download another app in order to transfer money to or from fellow iPhone owners.

One of the best things about Apple Pay Cash is that it’s well-integrated with iOS, and as long as you have set up Apple Pay with a credit or debit card, you can quickly and easily send money through the Messages app. To send or receive money, open up a thread in the Messages app, hit the Apple Pay icon on the keyboard, choose the amount, and hit the “Request” or “Pay” button.

Fees, transfer times, and limits are pretty good with Apple Pay Cash. There are no fees to send, receive, or request money. If you don’t have an Apple Cash balance, you can use a debit card. You’ll be able to transfer up to $10,000, and will incur a 3% fee when using a credit card. Once you have money in your account, you can transfer it to your actual bank account in one to three business days for free, or opt for an Instant Transfer, which attracts a fee of 1% (min 25 cents, max $10) and should arrive within 30 minutes.

There are a few downsides to Apple Pay Cash, the main one being that it’s only compatible with iOS — so you won’t be able to use it with people on

Which one should I use?

Choosing the best payment service varies based on your needs, just like with financial apps, game consoles, and streaming services. PayPal is still leading the market if you require a line of credit or a universally accepted service designed for online commerce.

If you’re an

Venmo is our pick if you need to send or accept payments from individuals such as friends, but Cash App is a close second.

We recommend downloading more than one payment service so you can switch between them depending on the type of transaction and device you’re using.

It’s also worth looking into your financial institution’s peer-to-peer transaction options since many banks now provide ways to send money to individuals through their mobile apps with services such as Zelle.

Editors' Recommendations

- Samsung Pay vs. Google Pay

- Google Fi: Phones, plans, pricing, perks, and more explained

- Waze vs. Google Maps: Which one is right for you?

- Apple iPad Mini 5 vs. iPad Mini 4

- Cortana vs. Siri vs. Google Assistant vs. Alexa