Before any words of caution could leave my mouth, the cashier was violently swiping my new Coin card back and forth through the card reader — the way seasoned workers will do. She handed the card back to me saying it didn’t work, but not before also commenting that there wasn’t a Visa or MasterCard logo on the Coin.

Even if I had managed to get some words out in time I’m not sure what I would have said. Things like, “I paid $50 for that card” or “It’s in beta” surely wouldn’t have convinced this Taco Bell cashier to take it easy on my new experimental credit card.

A new way to pay

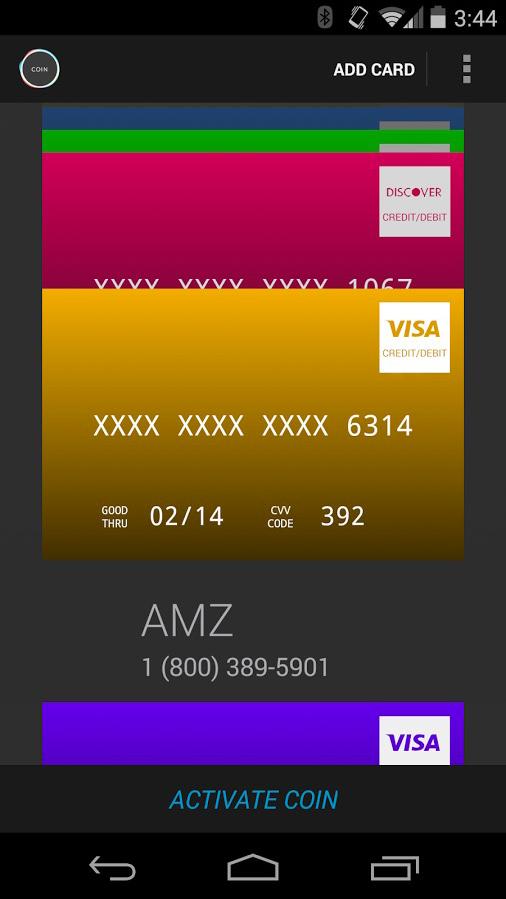

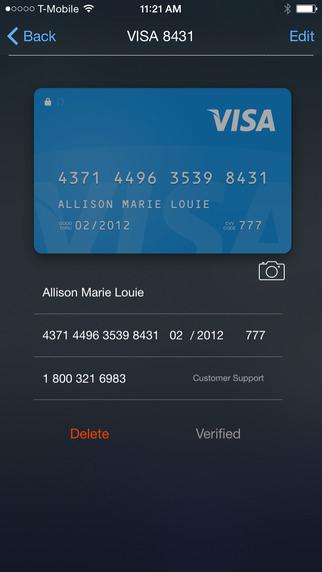

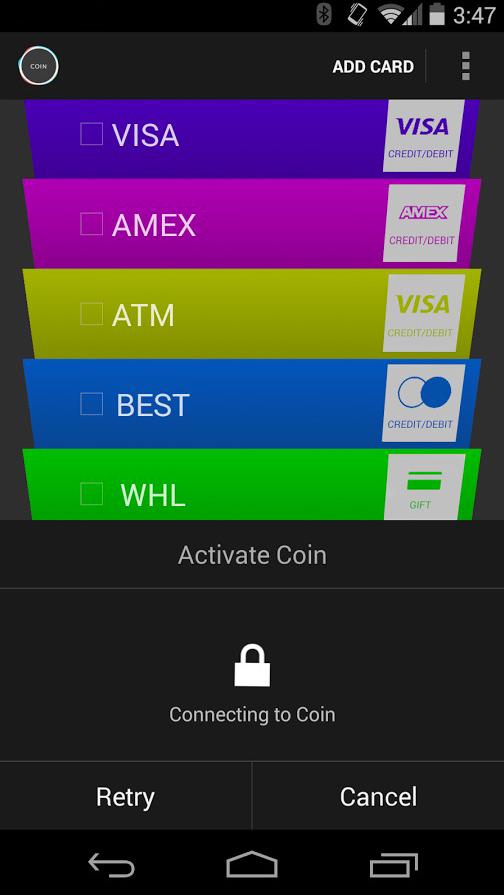

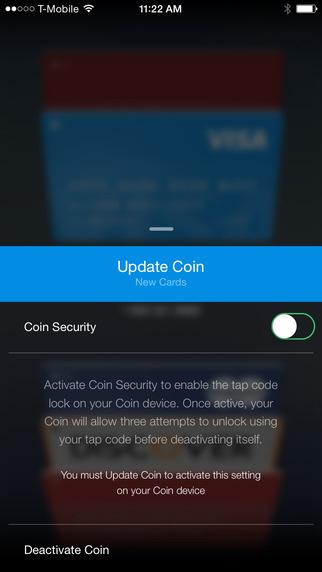

Coin doesn’t have any logos on its black exterior because it’s not one card, of course, but rather eight different ones. Connecting Coin to your mobile phone — over Bluetooth low energy — allows you to load it with existing credit and debit cards, as well gift cards and membership cards. An E-Ink display on the front shows the last four digits of the card and its expiration, while a button directly underneath the screen allows you to cycle through them. When you select one, the magnetic strip on the Coin mimics that card — it should scan identically to the real thing.

15 percent, in actual use, feels like a much bigger deal.

When I first received my Coin, it was impressive. It was advertised to feel like a regular credit card, but for some reason, knowing what it could do, it always seemed like it would feel different — maybe thicker or heavier. But it doesn’t. It’s smooth and thin and pretty elegant.

After feeling the card up, the next step was to get my physical cards added to it. Using the iOS app (an Android version is also available), I was able to quickly put two payment cards on it, as well as my Costco card. Coin comes with a card reader that works like Square — plugging into the headphone jack.

Everything on the software side worked the first time. On first impression, it seemed that a plastic card might be in my future after all — instead of using a phone and mobile payments. Unfortunately, the second time dealing with the app was less productive.

Since first setting up Coin, I got a new phone. So when I went to add a card in the iOS app, I had to unlink my first phone and re-setup all my original cards again. The whole process, I can only imagine, is built around being secure, but quickly got annoying.

What is that thing?

As far as actually using Coin, it’s been a mixed bag.

My first time using Coin was at a drive-through, and it actually went smoother than my later Taco Bell experience. After pulling up to the window and pushing the button on the card to turn it on, I handed it to the guy working the register. He looked at it cautiously, but the only comment I got was, “What kind of card is that, it’s cool.” I simply nodded in agreement — again, not enough time to explain the scope of what he was actually asking.

Using Coin is a constant exercise in quickly explaining a new product and trying not to be taken into custody.

I quickly started trying Coin at restaurants, grocery stores, and other places I typically go, to see how often it would work. Overall the results lined up with what the company tells beta testers like me to expect: it works about 85 percent of the time because of different types of card readers. The only problem is that 15 percent, in actual use, feels like a much bigger deal.

If Coin fails to work at a self-serve gas station pump, it isn’t a huge deal: I just pull out another card. Crisis averted. Handing it to a cashier and seeing it fail is a much bigger deal. Since there are no card numbers on the front and no credit logo, it looks a lot like potential fraud to suspicious cashiers.

I tried to use Coin at Walmart two separate times and it failed at both. Each time, after a message came up saying the card was declined, the cashier wanted to see it. This wasn’t out of a pleasant curiosity, it was the skepticism you apply to catch people knowingly writing bad checks. I put the Coin away and paid with a different card.

This wasn’t the only time Coin failed to be read by a machine, but it was definitely one of the ones that put a little fear in me about using the futuristic card. There’s now a little bit of hesitation every time I reach for Coin to pay.

When Coin set up its crowdfunding campaign in November of 2013, I was all in. It seemed like magic that a card could connect to your phone, instantly be disabled if it was lost or stolen, and change the magnetic strip to house multiple cards. But the delays started, Coin wanted more money for the finished version, chips in future credit cards threatened to antiquate Coin, and reality kicked in.

Before Coin could even roll out in beta form, Apple had already released its mobile payment system, Apple Pay. Using Apple Pay or Google Wallet can be awkward, but it’s never seen as fraudulent. Worst case, you look silly tapping your phone to the payment terminal.

Swiping off more than you can chew

Coin mostly delivers on its initial promises. The hardware you hold in your hand seems surprisingly solid, and it works, most of the time.

But it’s unclear whether Coin will ever reach 100 percent reliability, or become popular enough to overcome suspicious glances from cashiers. Based on my initial time with the beta version, I’m not too optimistic. The problem is that using Coin is a constant exercise in quickly explaining a completely new product and trying not to be taken into custody.

A startup company trying to launch a new gadget faces a real challenge. A startup company trying to completely upend an entrenched system of money and payments exists on a completely different scale of difficult.

Coin still has the potential to be awesome, but it quickly left me gun shy.

The final version of Coin is currently available for preorder for $100, with orders expected to ship in the summer of 2015.