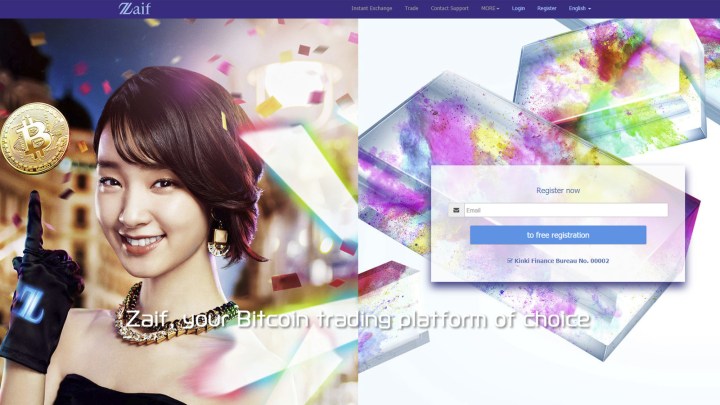

As much as cryptocurrencies like Bitcoin might have an inherent volatility that encourages investors to jump on great opportunities, exchange bugs aren’t one of them. In the case of Japan’s Zaif exchange accidentally setting Bitcoin prices to $0, one enterprising investor attempted to pull out 2,200 trillion yen from the service, or around $20 trillion.

The bug in question meant that the government registered Zaif exchange had a 20-minute window last week whereby Bitcoin prices were locked at $0 for all purchases. Unsurprisingly, many customers took advantage of this flaw and tried to buy up mountains of the scarce digital commodity, only to try and resell it later for an enormous profit. Nobody was quite as ambitious as one customer though, who attempted to profit more than 100 times that of Bitcoin’s entire global market value.

Once the bug in its system was discovered, Zaif quickly voided all transactions that took place during that window, as Reuters reports, but that hasn’t stopped the potential Bitcoin trillionaire from trying to hold on to their impossible returns.

This exchange bug and related fallout come at an interesting time for cryptocurrency relations in Japan, which recently announced it as an accepted means of payment. That is a move that is rare in all economies, let alone first world ones, and is likely to be used as a case study by others in the effectiveness of such a tactic.

Although we aren’t particularly concerned about global attempts to ban or regulate cryptocurrencies, countries like China have taken extreme measures to do so and there is a wonder of which precedent will have the biggest impact moving forward.

Zaif and 15 other exchanges have been registered in Japan so far, with plans for all of them to form part of a regulatory body for the cryptocurrency industry come April. Together they will set out rules and regulations to help maintain a healthy industry whilst helping to prevent the illegal practices cryptocurrency is occasionally used for, such as online purchasing of illicit substances and money laundering.

It’s not clear yet what such a regulatory body would do to exchanges that were found in breach of its rules, though penalties of some sort would be implemented.

Editors' Recommendations

- The best Bitcoin wallets to hodl, trade, and exchange crypto

- How to buy Bitcoin with PayPal

- The best bitcoin alternatives

- Dozens of major Twitter accounts hacked in massive Bitcoin scam

- Ethereum vs. Bitcoin: What’s the difference?