The latest update to the Zently app not only simplifies the rent payment process but also now allows roommates to easily reconcile shared expenses such as utilities or groceries. The app can collect rent from multiple roommates in one place, giving the new app a leg up over competitors like PayPal, Venmo or Square Cash. The app is currently available for free on the Apple Store and Google Play Store.

The app is specifically targeted toward markets like San Francisco, Silicon Valley, Seattle and other high-tech, high-density cities where a large number of renters under 30 have roommates. The Zently app hooks up with a renter’s bank account to scan for shared bills like utilities and reconcile bills once the month ends. Zently will even remind roommates if they haven’t paid a bill on time.

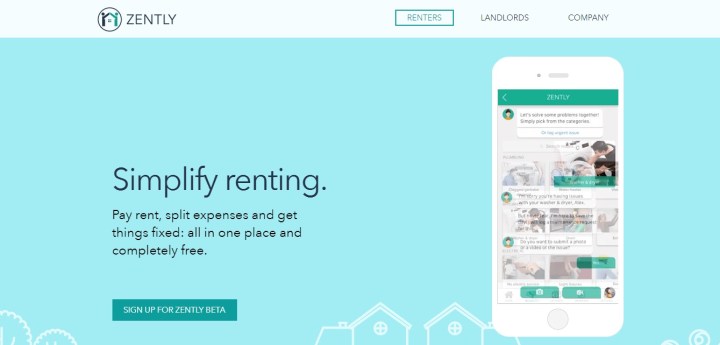

The app’s functionality also targets a renter’s need for maintenance issues in a unique way. The app uses a chat-based interface that allows Zently renters to categorize their maintenance request, take a photo of the problem, and submit it to their landlords. But before that step, the app also guides renters through helpful tips and how-to videos to solve common problems such as clogged drains or nonfunctioning garbage disposals.

The startup is augmenting this function with a 24/7 Premium Concierge Service that makes it easier for landlords to find plumbers, electricians, or generalist handymen. The Premium Concierge also allows access to Zently’s market dynamics studies as well as recommendations on pricing, property fixes, and other upgrades to make the rental property more attractive to tenants.

Zently’s model offers three pricing tiers for landlords including a free base model that only processes rent checks or direct deposits; Zently Helper for $49 per month, which features a “Designated Property Helper” package that includes maintenance, rent collection and best practices for lease writing, rental rates and evictions; and Zently Premium for $89 plus $10 per bedroom that includes services to help landlords find renters as well as credit and criminal background checks. Zently is also planning to implement a “smart dashboard” for landlords that includes at-a-glance access to vital information like taxes and local rental rates.

Based out of the flourishing startup market in Redwood City, California, Zently has already raised $1.6 million in equity funding during two rounds from a total of 15 investors, led by Montage Ventures, Oberndorf Ventures, and several strategic investors in the lucrative Bay Area real estate market. Founders Sachit Kamat and Aleksandr Movsesyan are LinkedIn veterans with a few other entrepreneurial ventures in their history.

Zently is entering a fiercely competitive market, facing not only financial apps from behemoths like Bank of America, Wells Fargo, and Capital One but also other rental platforms like Venmo, Homeaway, and OneRent, not to mention niche services like Cribspot, Loftsmart and Trulia’s Room for Rent.