After a limited four-month trial period, T-Mobile is finally launching its T-Mobile Money banking service to the entire U.S., offering a powerful banking service with extra perks, and none of the usual fees.

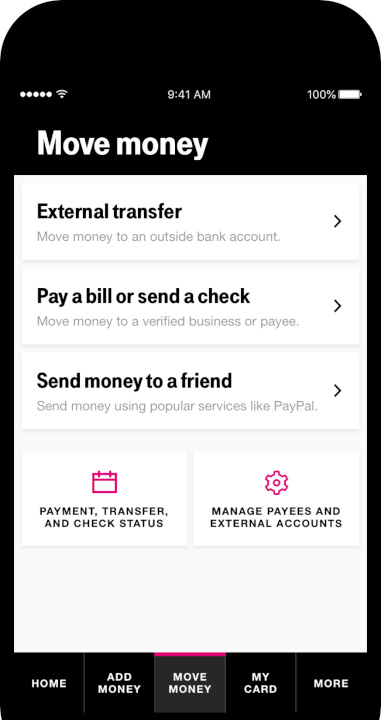

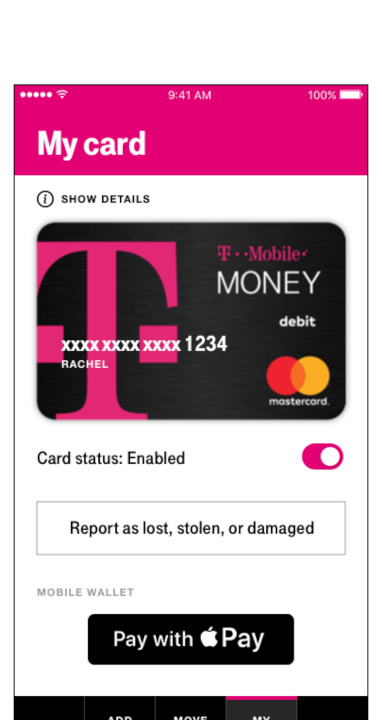

It’s not your usual banking service. As you might expect, it’s proudly mobile-first, which means a powerful mobile app on your Android or iOS smartphone. Boot up the T-Mobile Money app and you’ll be able to do everything you expect from your banking service, from checking your account balance to sending checks, or even sending direct person-to-person payments. The app also supports Apple Pay, Google Pay, and Samsung Pay, biometric logins — including fingerprint sensors and Face ID — and also comes with the ability to lock a lost debit card or send an alert when your balance is low.

Unlike Apple Card, there are no credit card services. T-Mobile Money is strictly for checking accounts, but there are nifty perks.

Every customer will get at least a 1% Annual Percentage Yield (APY) on their balances. T-Mobile customers who deposit at least $200 a month will receive a 4% APY on accounts up to $3,000 — a rate T-Mobile claims is 50 times the average U.S. checking account interest rate. Once you’re above $3,000 then you’ll earn 1% APY on every dollar over the threshold.

Best of all, T-Mobile is dedicated to preserving as much of your money as possible, and won’t charge any of the usual bank fees. That means no overcharge fees, account fees, or charges for withdrawing your own money. Additionally, if you’re a T-Mobile postpaid customer, then you also qualify for Money’s Got Your Back overdraft protection, which gives you a $50 overdraft protection without charges, as long as you pay it back within 30 days. It’s not only your money the carrier is protecting, either, as T-Mobile confirmed to Digital Trends it will not sell or share customer data, and neither will BankMobile, the FDIC-insured bank supporting Money.

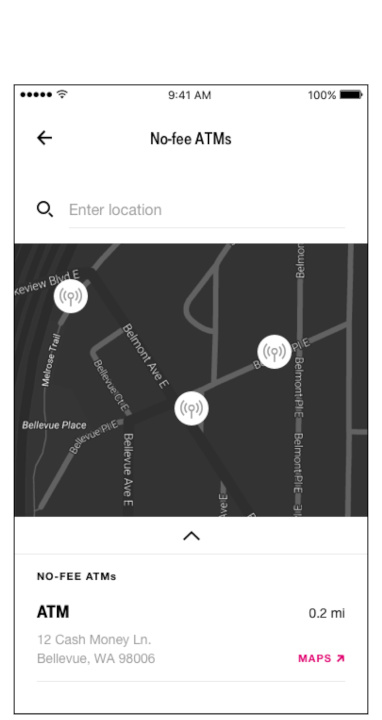

There’s no need to worry you’re restricting yourself to a digital-only account either. T-Mobile Money comes with a Mastercard debit card, and you can withdraw cash (free of charge, remember) from over 55,000 Allpoint ATMs worldwide — including ATMs from Bank of America, Chase, and Wells Fargo. T-Mobile Money is FDIC-insured up to $250,000, and comes with 24/7 bilingual support, which is handled by BankMobile.

This has been a longstanding ambition for T-Mobile, with similar efforts launching in 2014. To get started, you can download the T-Mobile Money app for Android or iOS, and sign up with your T-Mobile ID. If you’re also looking to keep a tighter hold on your money as well as boosting it with Money’s APY rate, then check out our favorite budget apps for Android and iOS.

Editors' Recommendations

- T-Mobile adding a free year of Apple TV+ to its most expensive plans

- T-Mobile lures subscribers with 500GB of Google One cloud storage for $5 a month

- Tons of T-Mobile subscribers just got a free year of Apple TV+

- T-Mobile partners to promote Google apps for messaging, cloud storage, and TV

- T-Mobile’s Home Office Internet service brings 5G to businesses nationwide