“The way we spend money has evolved,” Mokhtarzada, CEO and co-founder of Truebill, told Digital Trends. “Every dollar you spend, check you write, and card swipe you complete happens automatically. It’s almost too easy.”

He gave a personal example: Gogo’s in-flight Wi-Fi. “I looked at my credit card statement one day and saw a charge for in-flight Wi-Fi,” Mokhtarzada said. “It wasn’t a one-time charge like I thought, but a $40 dollar-a-month subscription over 14 months. Turns out I’d inadvertently subscribed.”

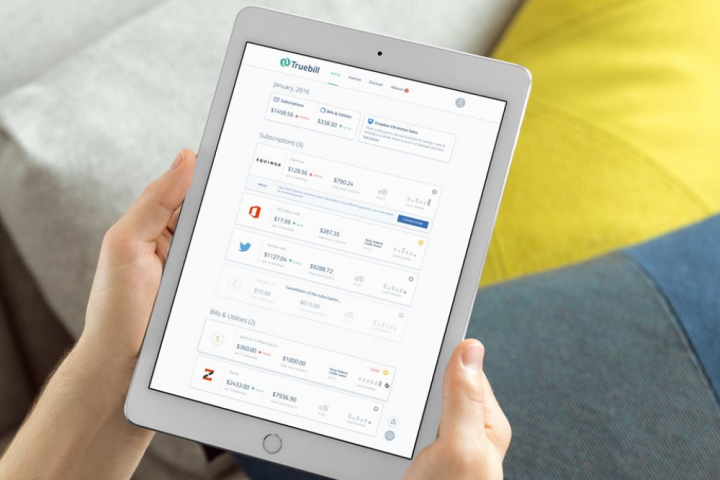

Y Combinator-backed Truebill, which Mokhtarzada launched with his brother, Idris, a year and a half ago, uses a combination of machine intelligence and human curation to nip errant subscriptions in the bud. Once you link a bank account or credit card, Truebill automatically identifies recurring subscriptions and alerts you each time you make a payment.

“It tries to solve inefficiency,” Mokhtarzada said.

But starting this month, Truebill will start handling more than subscriptions. It’s publicly launching bank-fee tracking, a service that’s been in beta the past several months. Doing so required “reverse-engineering” the process that banks use to issue late fees and overdraft processes, Mokhtarzada said.

It’s a little more complicated than subscription tracking. When Truebill detects a bank fee, it performs a “likelihood” assessment before reaching out to the institution.

“We try to determine whether the bank account is in good standing,” Mokhtarzada said, “and whether multiple fees have been charged in the past week or month.”

If the account is in good standing and the assessment finds a high chance of success, Truebill contacts a bank representative and attempts to secure a refund. Mokhtarzada said that refunds average between $35 and $45, and that the biggest refund so far was $135.

Bank-fee tracking works with “any mid-sized and large banks,” Mokhtarzada said, and the number of supported institutions is constantly expanding.

“It’s something that’s almost unexpected,” he said. “A lot of people don’t assume they can get a refund.”

One other killer feature Truebill has is its ability to cancel subscriptions on your behalf. If it’s a service Truebill has never tried encountered before, a human employee processes the cancellation. After it’s completed, Truebill reviews the process and tries to automate it to the extent that it can. E-mail signups like Netflix and Spotify are a cinch to cancel, Mokhtarzada said, but some services, like gym memberships, require a bit more work. Worse case scenario, Truebill requests information like a billing address and date of birth in order to generate and mail a certified letter for you.

To ensure cancellations are successful, Truebill monitors charges over subsequent weeks. If they aren’t, it issues a refund and attempts a second cancellation. Mokhtarzada said that happens about two percent of the time.

Truebill is free to use, a model Mokhtarzada said he’d like to keep, and it’s encrypted.

“All we know is that somewhere out there someone signed up and paid for Spotify and Hulu,” he said. “We follow industry practice protocols around security. But we also really don’t touch any login credentials that could compromise a user’s identity or bank accounts.”

Mokhtarzada hinted that Truebill’s next big project might have something to do with “pausing” subscriptions — i.e., putting a subscription on hold for a number of weeks and resuming it later. “Last summer, I went to Europe for two months on vacation […] but I continued paying for Spotify and Dollar Shave Club razors. I kept it going because I didn’t want to log into Truebill and have everything paused instantly. There is more to management than just skipping.”

Editors' Recommendations

- How to turn your old phone into a security camera

- I review phones for a living — here are the 10 apps I can’t live without

- App subscription fatigue is quickly ruining my smartphone

- The best hurricane trackers for Android and iOS in 2022

- New App Store rule lets companies charge more for subscriptions without approval