As usual, Apple arrived fashionably late to the party when it deemed NFC technology “ready” to hit the mainstream. Indeed, Apple’s timing could not have been better. Thanks to Google Wallet, PayPal, and mobile payment companies like Square, the general public is very much aware that it’s possible to pay for things with your phone.

Apple streamlined the process to near perfection, thanks to partnerships with major credit cards and banks.

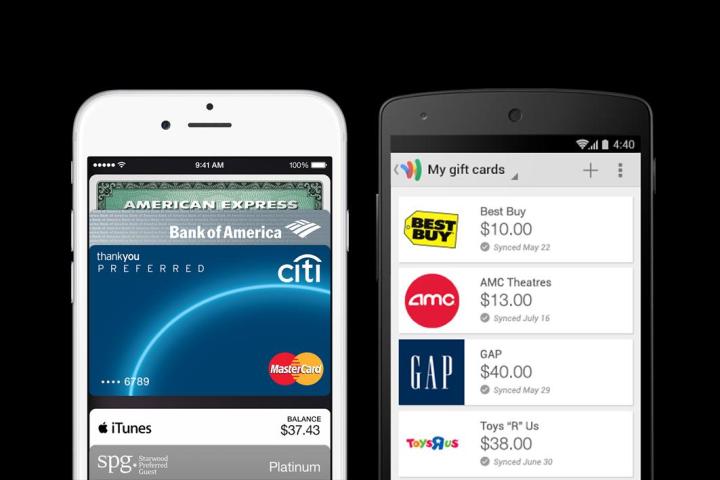

By now, you’ve probably already formed clear opinions about which mobile wallet you prefer and in reality, your choice is predetermined by your operating system: iOS users get Apple Pay and Android users get Google Wallet. The good news is that both systems are very easy to use.

I used both mobile wallets in multiple stores in New York City for a few weeks to get a better idea of how each one works. Here’s a fully detailed comparison of the two services:

Setup is easy for both, but different

It’s surprisingly simple to set up both Apple Pay and Google Wallet. Apple streamlined the process to near perfection, thanks to partnerships with major credit cards and banks. Google’s setup is slightly more invasive and complex, but that’s not entirely Google’s fault. Back in 2011 when Google Wallet debuted, the infrastructure of mobile payment security was messier and Google had to make its own system from scratch.

Related: CurrentC-Backing Retailers Can’t Use Apple Pay, or Fines

To set up Google Wallet, you’ll have to enter a bunch of info that you don’t know off the top of your head, including your account and routing number. It’s a little more complicated than Apple Pay’s setup, but you only have to do it once.

Here’s how to set it up:

- Open Wallet app

- Create PIN

- Verify ID

- Name

- Address

- DOB

- Last four digits of SSN

- Link bank account

- Account number

- Routing number

- Name on card

- Verify card by entering

- Bank website user ID and password

- OR a test deposit of $1, which takes 2-3 days

- Set up tap to pay

- Agree to terms

It took me five to 10 minutes to set it up because I had to look up my account and routing number. It was a little disconcerting to type in all my details – especially my full social security number, but since Google had to create its own secure system to vault users’ credit cards, it’s unavoidable. Apple Pay’s partnerships with banks allow it to avoid storing all your personal data on its servers. Instead, the card number, account number, and all your other sensitive data stay safely vaulted with your bank and credit card provider.

Apple’s partnerships and delayed entrance into the mobile payments space gives its wallet a leg up on the competition.

Apple Pay’s setup process is incredibly simple. Even though there are just as many steps involved, Apple makes it very easy for you. Typically, you won’t even have to enter your card information, as the camera will scan it for you. The first time I did setup Apple Pay, it took me less than a minute to add my first card.

Here’s how to set up Apple Pay:

- Open Passbook app

- Click set up Apple Pay

- Make sure Touch ID is set

- A screen prompts you to either:

- Use card on file with iTunes

- Use a different debit or credit card

- If you use the card already file, you simply verify the card with the security code on the back.

- If you add a new card, you’ll be asked for the following info:

- Name

- Card Number

- Expiration date

- Security code

- But you can just scan the card details with your camera by touching the blue camera icon next to card number section

Winner: Apple Pay

At the end of the day, it’s easier to set up Apple Pay. Apple’s partnerships and delayed entrance into the mobile payments space gives its wallet a leg up on the competition. However, Google Wallet is by no means difficult to set up in comparison with other mobile payment apps. Softcard in particular has a hellish setup process and even worse limitations, but we won’t go into that here.

Tap-to-pay and security

Tap-to-pay in the real world

Apple Pay and Google Wallet face the same challenges out there in the real world. First off, you have to find a store that accepts NFC payments and then pray that their tap-to-pay terminals are still fully functional.

Ironically enough, the publicity generated by Apple Pay’s arrival is really good for Google Wallet, too. Now users can easily find stores that accept the service, thanks to Apple’s list of partner retailers. Apple’s announcement that 1 million people signed up for Apple Pay in the first 72 hours might also inspire retailers to get on board and dust off their NFC-enabled terminals.

My first experience at Apple Pay was almost flawless. I walked into Panera Bread, made my order, tapped my phone against the terminal to pay, and pressed my finger against the Touch ID sensor. My payment went through and I cheerfully waited for my food. The cashier even remarked upon how cool it was. I didn’t have to wake my phone, open the app, or do anything else.

Google Wallet requires you to wake your phone and sometimes it won’t work unless you open the app.

My maiden voyage with Google Wallet was not so fun. I went to Duane Reade to test it out, but had the misfortune of getting the one cashier whose NFC terminal didn’t work. The line was long with irate New Yorkers, so I sheepishly paid with my credit card instead.

The same thing happened at another Duane Reade the second time, but the line was short, so I simply went to the next cashier and used her tap-to-pay terminal. Of course, I had to wake the phone and hold it just right for the payment to go through. I even opened the app to make sure everything processed. It took slightly longer and I had to select “Credit” on the touchpad of the payment terminal before it finally worked.

Of course, it seems that the problems I experienced had more to do with the retailer’s shortcomings rather than actual flaws in Google Wallet’s design or implementation. Still, the difficulties would be enough to dissuade your average American from using the app a second time.

The Winner: Apple Pay

Apple Pay offers a more streamlined and effortless approach to tap-to-pay. You don’t have to wake your phone, open the app, or enter a PIN to complete your purchase. You just tap to pay, press your finger to Touch ID, and you’re done. Google Wallet requires you to wake your phone and sometimes it won’t work unless you open the app. At the end of your purchase, you either have to select credit as your payment method or enter your Google Wallet PIN.

It’s these extra little steps that are annoying and slow down the process. Most customers aren’t going to put up with Google Wallet’s eccentricities. At the risk of sounding like a total Apple fan girl, Apple Pay just works.

Security is paramount – especially when it comes to credit cards

Most people who are skeptical about Apple Pay point to Apple’s recent failures to keep user data safe from hackers and say, “I’d never trust Apple with my credit cards!” What they don’t know is that Apple doesn’t store their credit card info and the actual card number is never shared with merchants. Apple Pay users’ data is vaulted with the same people who already have all their info: the credit card companies and banks. Essentially, if you trust your bank, you can trust Apple Pay.

Also, you can only use Apple Pay if your fingerprint matches the one on file, so criminals can’t steal your phone and buy things on your account.

Of all the mobile payment apps out there, Apple Pay and Google Wallet are undeniably the best of the lot.

Although Google Wallet is locked with a PIN, thieves could still theoretically steal your phone and use it to make payments if the PIN lock is disabled. The addition of a fingerprint sensor to Apple’s system does lend extra security.

The Winner: Apple Pay

Apple’s partnership with big banks and credit card companies makes its mobile wallet safer and removes the risk of data breaches in stores and hacks on Apple’s servers. The Touch ID fingerprint sensor on the new iPhones also adds another layer of security to Apple Pay.

The final verdict

Of all the mobile payment apps out there, Apple Pay and Google Wallet are undeniably the best of the lot. Apple Pay has a slight edge when it comes to set up, ease of use, and security. Touch ID gives Apple pay the advantage and its partnerships with big-name retailers, banks, and credit card companies give it a leg up on the competition. The app’s design is also more intuitive and simple.

Google Wallet’s strengths lie in its ability to work with any credit card or bank, it support for loyalty cards, and it’s ability to send and receive money like PayPal. Setup and real-world implementation still need some work, but for Android users, there is no better payment app.

Overall winner: Apple Pay

As mobile payments go mainstream and more retailers support the service, Apple Pay and Google Wallet will undoubtedly emerge as the two leading mobile wallet apps. However, at this juncture, Apple Pay comes out on top.

Editors' Recommendations

- A new Google Pixel Tablet is coming, but it’s not what you think

- What is NFC? How it works and what you can do with it

- Best iPhone 15 deals: How to get Apple’s latest iPhone for free

- Google just released the first Android 15 beta. Here’s what’s new

- This Google Pixel 8a leak just spoiled everything about the phone