Somehow undeterred by the current government shutdown, the Securities and Exchange Commission has published the Form S-1 documents for Twitter. Although these were confidentially submitted almost a month ago (Twitter has quietly been working on its IPO for a while), the public filing marks the first formal step in transforming Twitter from a privately-held business to a publicly-traded corporation with its own stock symbol – TWTR. By offering stock to the public, Twitter hopes to raise about a billion dollars.

At over 160 pages (plus a bevy of forms and exhibits), the bulk of the S-1 material is as exciting as two-day-old pizza, but marks the first look under the hood at Twitter’s business, strategies, and ownership – and represents a level of transparency Twitter will have to get used to as a public company.

So: is there anything juicy in there?

How big is the Twitterverse?

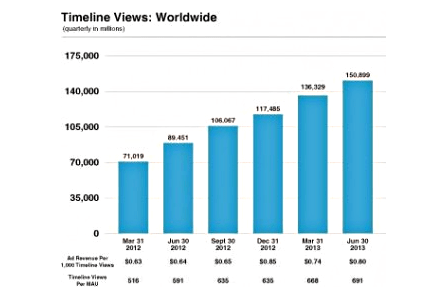

One of the ongoing mysteries of Twitter has always been “just how big is Twitter, anyway?” Individual account numbers long ago passed the one billion mark, but we’ve only had occasional statements from Twitter HQ (ironically, often in the form of blog posts) about how many people use Twitter and how active they are. No more. Twitter claims to have had an average of 218.3 million monthly active users for the three months ending June 30, 2013 – and that’s up from 151.4 million active users for the same three month period a year ago. Taken at face value, that means Twitter’s user base grew about 44 percent between mid-2012 and mid-2013 – and that’s the kind of growth any major online service likes to see. Moreover, Twitter claims that more than 100 million of those users are active every day. However, that 218 million figure is only up about 10 percent from the number of active users Twitter claimed to have in December of 2012 – what a difference a date range makes.

Either way, those numbers are huge, right? Huge is relative. For instance, Twitter’s user base is about one-fifth of the one billion monthly active users Facebook currently enjoys, and a quarter of the 800 million active monthly users over at Yahoo (and that’s excluding the recently-acquired Tumblr). Similarly, Twitter represents less than half the number of users who have active iTunes accounts, and Twitter’s smaller than Microsoft’s Outlook.com or Skype (estimated at 400 million and 300 million, respectively). Twitter may also be smaller than WhatsApp (estimated 300 million), and about the same size as the 200+ million users claimed by Amazon, Dropbox, Pandora, and Viber. Heck, on paper Twitter has fewer active monthly users than either LinkedIn or Google Plus … although figures for “active users” in Google’s social network should probably be taken with a grain of salt.

So Twitter isn’t the biggest fish in the sea. However, Twitter’s active user base is bigger (and growing faster) than eBay or Paypal, twice the size of Yelp, and around three times bigger than the likes of Pinterest, Flipboard, LivingSocial, Evernote, and Reddit. To be fair, some figures for these comparisons are older or fuzzier than others, but Twitter says its users generate more than 500 million tweets every day (that’s an average of five per user per day), totaling up to more than 300 billion tweets since the service went live in 2006.

The key to that engagement is probably Twitter’s famous 140-character limit, which forces content to be instantly digestible, easily shareable, and immediate. That also makes Twitter ideally suited to mobile devices: Twitter estimates three quarters of its active users access the service from a phone or tablet. In other words, Twitter doesn’t face the born-as-a-Web-site omg-how-do-we-go-mobile challenge that’s flummoxed everyone from eBay to Facebook. Twitter’s always been mobile, and mobile’s where the action is.

Surprise! Still losing money

For all that user engagement, Twitter still hasn’t figured out how to, um, not lose money. Twitter is pulling in cash: according to the S-1 filings, Twitter had revenue of $316.9 million for 2012, and pulled in $253.6 million in revenue just for the first half of 2013. However, none of that money is profit. Twitter lost $79.4 million in 2012 and had already lost $69.3 million more in the first half of 2013 when the S-1 was filed. In other words, Twitter is still burning through cash from investors – and that’s part of why it wants to raise a billion by selling stock.

From a business perspective, Twitter’s situation isn’t a disaster. Twitter’s revenues were up nearly 200 percent between 2011 and 2012, and up by more than 100 percent from June of 2012 to June of 2013. In terms of cash flow, Twitter is earning money faster than it’s losing cash – albeit slowly. If all things stayed on current pace, Twitter could claw its way to profitability.

Of course, things never stay on pace in the social media world: just ask MySpace.

Jack and Ev: It’s complicated

Need a little drama with your federal filings? It’s tucked in the footnotes. It’s no secret that the relationship between Twitter co-founders Evan (“Ev”) Williams and Jack Dorsey has been strained. They’re both former CEOs of the company, but Williams left Twitter’s day-to-day operations in 2011 after stepping down as CEO in favor of Dick Costolo in 2010. And when Williams left Twitter, Jack Dorsey came back – not as CEO, but as chairman of the company’s board. Dorsey’s still there.

So Ev is out? Nope. He’s still on the board and Twitter’s largest shareholder, owning about 12 percent of the company. Moreover, in a highly unusual deal Williams also controls the voting rights for Dorsey’s shares, which account for another 4.9 percent. Dorsey has a big voice at Twitter as its chairman (and let’s not forget he’s also CEO of Square) but he can’t vote his shares. The next largest individual shareholder in Twitter is Benchmark Capital’s Peter Fenton (with 6.7 percent) and a series of five venture capital firms (Benchmark, DST Global, Rizvi Traverse, Spark Capital, and Union Square Partners) that control five percent each. But Williams’ reach goes still further: in addition to his own shares and Dorsey’s, Ev controls more than 13 million shares owned by Rizvi Traverse. That brings the voting shares under Williams’ control to about 20 percent of the company. It would be difficult for Twitter’s board to do anything – like make strategic decisions or an acquisition – without William’s approval.

Williams’ unusual proxy voting arrangements will end when Twitter goes public. Nonetheless, Williams will remain Twitter’s largest shareholder. If things go well, he’ll probably be the only newly-minted billionaire of the bunch.

Interestingly, Twitter will have just one class of shares when it goes public: the shares everyday investors buy will carry the same power as shares owned by anyone else. However, the board does reserve the right to issue more-powerful “preferred” shares later if it likes.

What will Twitter going public mean for you?

How will Twitter change once it becomes a public company? The S-1 filings don’t have any answers – but they do have hints.

More Ads – After years pondering how to make money without driving users away, Twitter seems to have settled on the tried-and-true: advertising. Especially mobile advertising.

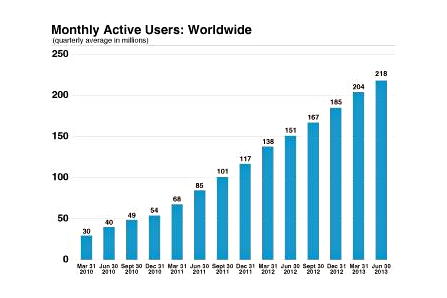

During 2012, 85 percent of Twitter’s revenue came from ads; for the first half of 2013, that crept up to 87 percent. Moreover, almost two thirds of that ad revenue came from mobile devices. So, the most financially rewarding thing Twitter can do is put ads on smartphones and tablets.

To be fair, Twitter has never gone in for tacky in-app ad banners: instead, advertisers mainly pay for Promoted Tweets, Promoted Accounts, and Promoted Trends. Right now, Promoted Accounts and Promoted Trends aren’t very visible on Twitter’s mobile apps: expect that to change. Twitter has also been rolling out new products for advertisers, like Twitter Amplify (which pushes targeted video clips to TV viewers) and Twitter Cards (which puts product images and info into Twitter streams). Twitter will also look to tighten partnership with traditional media – particularly TV. Twitter thinks 95 percent of conversation about live television happens on Twitter.

Act local, earn global – Twitter realizes it must continue to expand its base of active users. After all: if Twitter can’t continue to deliver large audiences, celebrities and brands will take their follower-count battles, selfies, and advertising dollars elsewhere. Twitter also realizes its growth rate will slow down, particularly in the United States. Twitter is already seeing this: according to the filings, 77 percent of Twitter’s active users are already outside the U.S.; however, just a quarter of Twitter’s revenue comes from outside the United States. That’s a big disparity, and Twitter needs to start generating more money from its international users.

Get creepy – Twitter is also going to amp up profile information it compiles of every Twitter user, euphemistically called their “Interest Graph,” based on who users follow, the contents of their tweets, and which tweets users interact with (by marking a favorite, replying, or retweeting).

“We believe a user’s Interest Graph produces a clear and real-time signal of a user’s interests, greatly enhancing the relevance of the ads we can display for users and enhancing our targeting capabilities for advertisers.”

That sentence is important enough that Twitter repeats it four times in the S-1 filings.

Keep it Simple

Twitter seems keenly aware its success to date is based on its simplicity: Twitter really is just 140 characters at a time, only from people you’ve chosen to follow. The danger of Twitter’s business strategy is that users will stop feeling like they’re getting immediate, easily handled messages from people (and maybe even companies) they care about, but feel they are simply targets for ads. The more promotions, tie-ins, product profiles, and offers that litter Twitter streams, the more likely users will tune out – even if the ads are relevant.

Editors' Recommendations

- Twitter’s SMS two-factor authentication is having issues. Here’s how to switch methods

- Don’t be like Pierre Delecto. Here’s how to keep your Twitter account a secret