The personal savings rate in the United States has rocketed to record levels in the face of recent global economic uncertainty, and while one can hope that good habits stick, we could all use a little push or some assistance in building our nest egg. We’ve taken the time to review and outline the best money-saving apps for iOS and Android. Whether it’s squirreling away some extra change, keeping a budget, or saving for retirement, these apps serve as a starting point for beginning savers and useful tools for seasoned investors.

If you’re interested in money-transfer apps or moneymaking apps, we also have separate guides on those subjects.

Mint

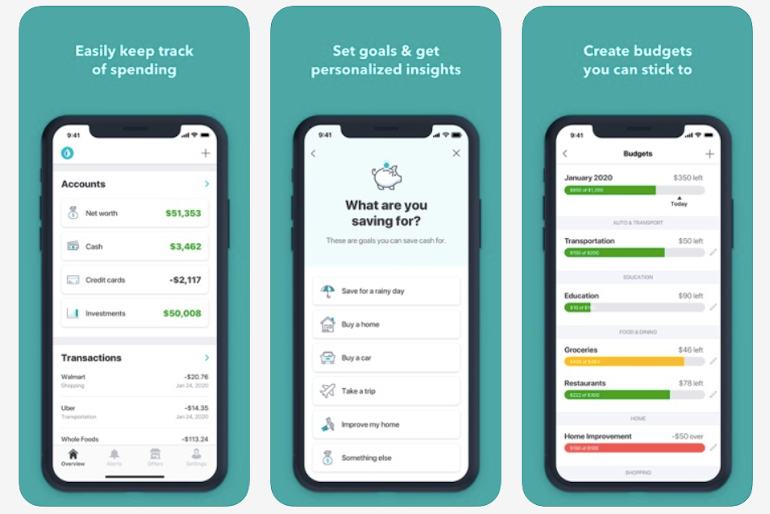

Mint is unequivocally one of the best personal finance platforms on the web. Owned by Intuit, the powerhouse behind Quickbooks and TurboTax, Mint.com and its corresponding app serve as a multi-tool approach to household and personal savings. Mint is a platform where you get out what you put in, as the more personal financial information you give it, the better equipped it is to help.

After syncing your varied accounts including but limited to credit cards, checking and savings accounts, and retirement or investment accounts, you can use Mint to track spending, net worth, and set budgets in all categories of your life.

Chime

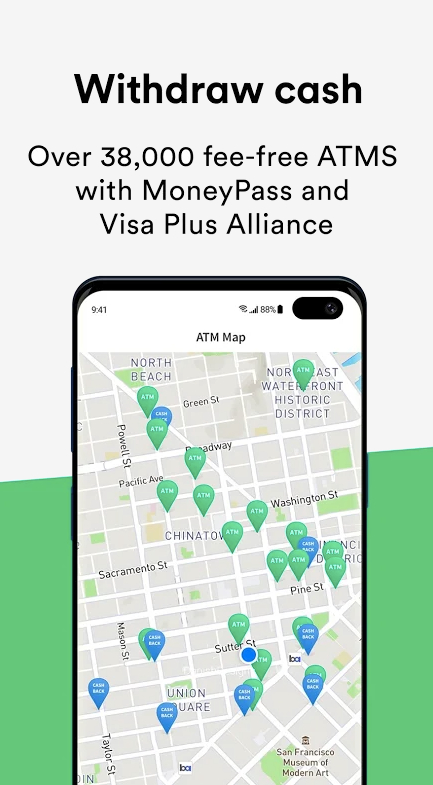

Chime isn’t simply a money-saving app, but also a mobile banking app that does more to help you save than apps from other digital banks. You can sign up for an account for free, and once you’re set up you’ll receive a Visa debit card, a checking account, and an optional savings account. So far, so normal, but what sets Chime apart from the crowd is that it introduces a range of features that will empower you to save more money.

Most notably, it includes an automatic savings feature, which automatically sends 10% of your salary to your savings account each month. It also includes an option to round up your purchases to the nearest dollar, so that you can send the difference to your savings. On top of this, you can even get a fee-free overdraft, as well as the ability to receive your salary two days early in some cases.

Again, Chime is very well designed as an app and easy to use. It’s free to download from the Apple App Store and Google Play Store.

Digit

Digit is another excellent money-saving app that works by automating your savings. Once you download it to your phone and connect it to your bank accounts, it basically works as a kind of algorithmic financial assistant. It can analyze your transactions and learn how much you can afford to save each month, at which point it will transfer this amount to an FDIC-insured Digit savings account. While this process is automated, you also have the option to adjust how much it puts away every month.

On top of this automated savings process, Digit also provides users with overdraft protection by notifying them when their checking accounts are low. It also makes it easier to withdraw your saved money than standard savings accounts, and offers 1% interest on savings (as of writing).

Digit is definitely one of the best money-savings apps around. The only small downside is that, after a free 30-day trial period, you have to pay $5 for a subscription. It’s available from the Google Play Store and Apple App Store.

Acorns

Acorns was founded in 2012 and launched on iOS and Android in 2014. Since then it has served as one of the largest leaps forward in bringing saving and investing within reach for millions of Americans across all income and finance education spectrums. The kernel of an idea that gave Acorns its start was passively saving money by rounding up your purchases to the nearest dollar and setting those amounts aside for a rainy day.

Today Acorns allows you to take this spare change and invest it in the stock market in a number of different accounts. “Acorns Invest” offers taxable investment accounts, “Acorns Later” offers Traditional IRAs, Roth IRAs, and SEP IRAs, while “Acorns Early” offers UTMA/UGMA accounts for your children to get a head start on saving. In each of these accounts Acorns will allow to choose your level of risk tolerance for investing in the stock market. These options range from “conservative” to “aggressive” with the former being heavy in bonds and the latter being 100% equities exposure.

No matter your path Acorns is a powerful tool to get started with saving and investing even if it’s just with your spare change. No amount is too small to start with, and it’s never too early to start.

Acorns is free to download, but charges for subscriptions at $1, $3, or $5 per month for Lite, Personal, and Family accounts.

You Need a Budget

You need a budget, so why not download the You Need a Budget (YNAB) app? This is another great money-saving app that lets you track all of your accounts and transactions in a single place, enabling you to save money in the process. It lets users set their financial goals and also offers helpful estimations of when they’ll reach them, assuming that they follow the given budgeting advice. It also provides regular trend reports on your spending that help you track just how well you’re doing in saving money.

One welcome addition that YNAB brings is that it grants users the right to join free online budgeting workshops. This really rounds out the advice the app provides, giving users a greater knowledge of how to budget and save money.

YNAB is free to download from the Apple App Store and the Google Play Store. However, it charges for a monthly subscription once the 30-day free trial is over, beginning from $11.99. Despite this expense, it claims that new users save $600 on average in the first two months.

Honey

Honey is a money-saving app for all the shoppers out there. It’s designed for anyone who wants to save money when shopping online but doesn’t have the time to root around for virtual coupons. Downloadable onto Android and iOS smartphones, it works as a browser extension that automatically searches for coupons whenever you’re about to go to an e-commerce checkout.

Honey automatically applies coupon codes for you at all applicable websites, and its makers say that it covers over 400 stores and millions of items. As such, it provides a great way of cutting down on your monthly shopping bill, while still enabling you to treat yourself every once in a while.

It also provides a number of additional features, such as notifications for when discounts are available on items you’ve saved to a wish list. It’s free to download from the Apple App Store and Google Play Store.

Editors' Recommendations

- An Apple insider just revealed how iOS 18’s AI features will work

- 10 iPhone productivity apps you need to download right now

- When will Apple release iOS 18? Here’s what we know

- This could be our first look at iOS 18’s huge redesign

- iOS 18 could add a customization feature I’ve waited years for