- Home

- Computing

Computing

About

News, reviews, and discussion about desktop PCs, laptops, and everything else in the world of computing, including in-depth buying guides and daily videos.

The best budget CPUs you can buy in 2024

Asus ROG Zephyrus G16 review: challenging my expectations

Is this Razer’s Steam Deck killer?

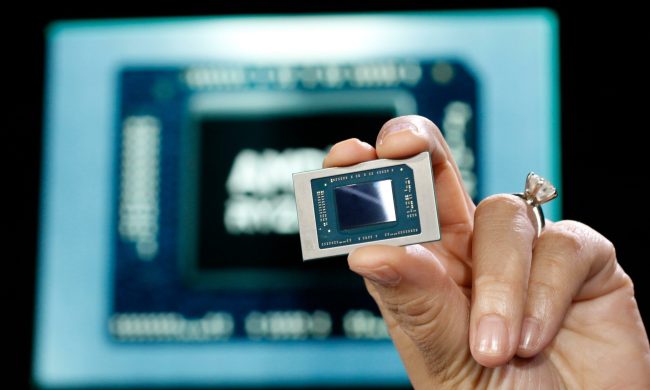

AMD Zen 5: Everything we know about AMD’s next-gen CPUs

AMD’s next-gen CPUs are much closer than we thought

It’s time to stop believing these PC building myths

The 5 best laptops for accountants in 2024

The best 5K monitors you can buy for max resolution

9 best processors for PC gaming: tested and reviewed

These 4K monitors are discounted at Best Buy — from $200

The XPS 16 is fighting an uphill battle against the MacBook Pro

These 6 tweaks take MacBooks from great to nearly perfect

My most anticipated laptop of the year just got leaked

These TP-Link mesh Wi-Fi systems are up to 40% off right now

The 5 best laptops for architects in 2024

Ghost of Tsushima is already shaping up to be a monster PC port

Lenovo sale: Get up to 67% off ThinkPad Laptops, from $600

Alienware sale: Get up to $1,000 off gaming laptops and PCs

How to set up Windows 11 without a Microsoft account

Best Buy’s deal of the day is $150 off the MacBook Air M2

The 6 best 2-in-1 laptops for drawing in 2024

Does RAM speed matter for PC performance?

Quest Pro 2: What we know about Meta’s next premium VR headset

Computing News

Laptops

Computing Reviews

Computing Guides

Modern processors are exceedingly powerful, but you don't have to buy a flagship design to get a great chip. The best budget CPUs can hold their own and punch well above their weight in gaming and productivity. But you don't want to lock yourself into an old ecosystem. All of our favorite budget CPUs offer excellent performance today, and great upgrade potential for the future, too.

More interested in the best CPUs overall? Here's our list of the top processors for 2024.

AMD Ryzen 7600X

Best budget processor for most

- Six high-performance Zen 4 cores

- Lots of upgrade potential

- Affordable price

- Energy efficient

- Requires DDR5 memory

The AMD Ryzen 5 7600X is one of AMD's budget CPUs for its latest Ryzen 7000 generation, and though at $200 it's more expensive than most of the other models in this roundup, it's arguably the best budget CPU for just about anyone.

It comes with six high-performance Zen 4 cores, each able to run close to 5GHz when maxed out, or even higher in gaming. It does this with a modest TDP of just 105W, so this CPU is perfect for compact systems. It has a built-in GPU, too, so you don't even need a graphics card to use it for basic office work and web browsing. That GPU isn't very powerful, though, so consider a dedicated graphics card or another CPU for gaming without one (see below).

Since this processor is on the ground floor of AMD's new AM5 socket, too, the 7600X offers excellent upgrade potential. For several generations to come, you'll be able to do a simple BIOS update and just drop a new CPU into your motherboard for next-generation performance — no new motherboard required.

Intel Core i5-13400

Best budget Intel processor

- 10 cores for high-end performance

- Powerful in productivity and gaming

- Low 65W TDP

- Supports DDR4 and DDR5

- Limited upgrade potential

- Lacks overclocking support

Intel's 13th and 14th generations are often maligned as too hot with too much power at too high a price. But there are some excellent budget models hidden among them, including the Core i5-13400. It sports six performance cores and four efficiency cores, making it punch well above its weight in productivity tasks, and its high clock speeds make it great for gaming, too.

The TDP is just 65W, which makes it much more efficient than most of its Intel peers, and it has onboard graphics, so you don't even need a graphics card to play casual and indie games with it. It supports DDR4 and DDR5 memory, so you can save a few dollars on cheaper memory and motherboards if you want to.

The upgrade path isn't bad on this chip, with options in the 13th and 14th generation, like the 13600K or 14700KF, but the top chips are harder to recommend. Once Intel Arrow Lake launches, you'll need a whole new motherboard to upgrade from there.

Intel Core i3-12100F

Best budget processor under $100

- Four high-powered Alder Lake cores with hyperthreading

- Low 58W TDP

- Priced under $100

- Lots of upgrade potential

- No onboard graphics

The Intel Core i3-12100F is a few generations old, but it still holds its own in gaming and productivity thanks to its four high-powered Alder Lake cores, high clock speed, and support for hyperthreading giving it eight threads to work with. It doesn't have onboard graphics, so you will need to pair this with a graphics card — or opt for the slightly more expensive Core i3-12100 — but it's great for entry-level gaming or day-to-day office work and homework.

It supports DDR4 memory, so you can further cut costs on your build if you wish, and with its low TDP it's great for more compact systems where heat and power are more of a factor.

The upgrade path for this CPU isn't bad, either, with options among the 12th, 13th, and 14th Intel generations to pick from. You can also upgrade to DDR5 memory for further affordable performance improvements down the line.

AMD Ryzen 5600G

Best budget CPU for gaming without a graphics card

- Six powerful Zen 3 CPU cores

- Strong onboard graphics for casual gaming

- No graphics card required

- Locked into an old-generation design

- Lacks the CPU power of its contemporaries

AMD's last-generation Zen 3 CPUs might be a little long in the tooth, but if you want a budget, low-power gaming PC they're still one of the best ways to do it. The Ryzen 5 5600G has six Zen 3 cores and Vega 7 graphics, making it more than capable of playing lightweight, casual, and indie games without a graphics card. You can even play AAA titles if they're older and you switch all the settings to low — just don't expect great frame rates.

This CPU does sacrifice processing power for that added GPU, unfortunately, meaning you will get better performance from its generational contemporaries, like the 5500 and 5600, but you'll also need a graphics card in those cases. If you can stretch your budget a little further, the Ryzen 5 8500G is much faster and has a newer CPU and GPU design, but you'll also need a new motherboard and DDR5 memory, so it's not quite so budget in design.

Upgrade potential with the 5600G isn't great if you never add a GPU to the mix, but if you can get a cheap graphics card you can always upgrade to the excellent 5700X3D, which is almost as good as the 5800X3D — the best gaming processor of its generation.

Intel Core i5-12600KF

Best $150 budget CPU

Intel's Core i5-12600K was arguably the best gaming processor of its generation, with six performance cores and four efficiency cores, making it excellent for multitaksing and productivity work, too. It's a little outdated these days, but it's still impressively powerful and now available well below $200.

You can save yourself even more money by buying the 12600KF, which at around $150 at the time of writing is arguably the best budget processor out there. Its lack of onboard graphics is a problem, though, because you'll need a graphics card, which adds its own expense.

Still, if you do buy this CPU (or the standard 12600K), you'll get amazing performance, and the option of overclocking it, which can make this processor much more capable — especially in gaming.

Want a little more help picking the right CPU for you? Check out our CPU buying guide, or our collection of the best gaming CPUs you can buy in 2024.