Your smartphone isn’t just a device to keep you in touch with friends and family; it’s also a powerful personal finance tool that can set and meet your financial goals. Whether you’re looking to set a budget, track your expenses, or invest your money, there are plenty of apps for your smartphone.

Read on as we take a look at three of the most popular finance apps for your smartphone and share some tips on how to get the most out of each one.

Mint

Best for: People who hate thinking about money

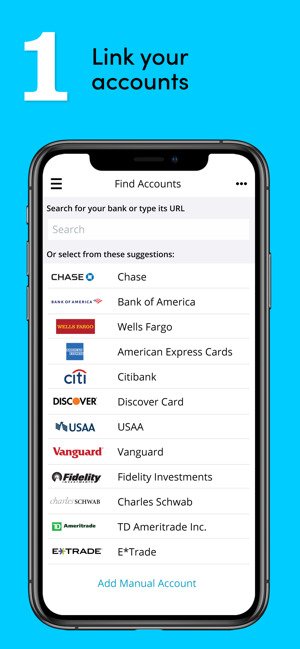

Purchased by Intuit (the folks behind Quicken and TurboTax) a few years ago, Mint is the most complete and mature free financial app available. It’s also the easiest to use for newbies. When you sign up, Mint presents you with a straightforward list of accounts to track, from credit cards and bank accounts to loans and insurance. It also includes those handy monthly bills like internet, TV, phone, electricity, and rent. Link them all to Mint and it can send you reminders as well as build a detailed budget.

Mint also gives you more fine-grained options when it comes to access to your data. For example, rather than just opening up all your accounts at a particular bank to the app, you can choose specific accounts at your bank to allow or block (the other apps simply gain access to all of them automatically). The program can create automatic budgets, based on previous patterns, such as looking at all your grocery spending from last month, and then telling you what you have left to spend this month. Mint allows you to add goals, such as paying off a credit card, saving for retirement, buying a home, or taking a vacation (you can also set your own customized goal).

If you’re looking to reduce credit card debt, for example, Mint will spell out explicitly how long it will take to pay it off by just paying the minimum, how much interest you’ll end up paying (shocking), and offer suggestions like using your debit card more to make purchases (in other words, quit charging). An easy sliding graphic shows you that just adding a few dollars a month can shave years off repayment and save you thousands in interest.

Mint is one of the programs that also allows you to share your goals online with Facebook friends but again, we don’t recommend doing so for security reasons. Also on the downside, Mint will email you pitches from partners for investment, loans, and banking services (which you should ignore).

Additional benefits of Mint include a well-designed online interface when you want to get a bigger picture on your laptop or PC. And at the end of the year, you can easily port over all your financial information to TurboTax.

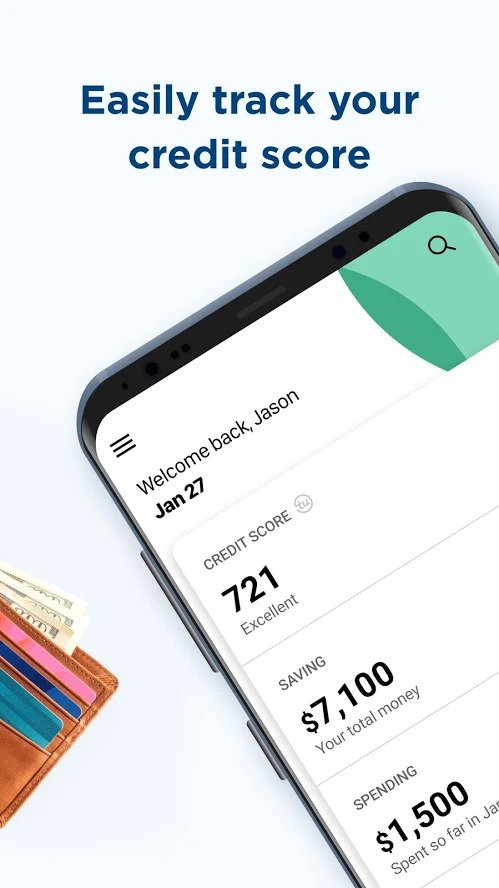

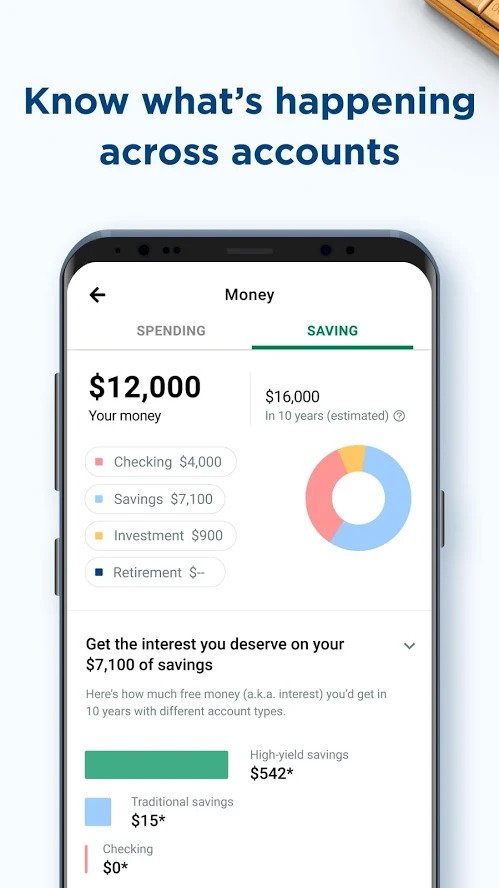

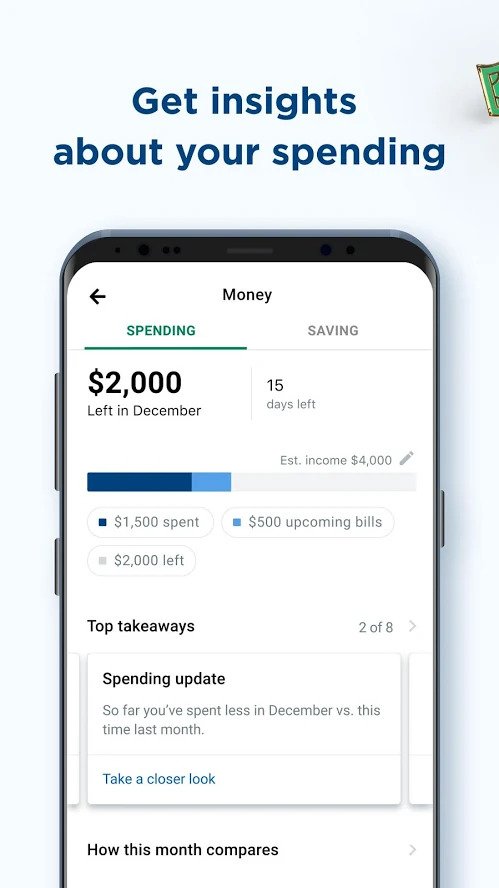

NerdWallet

Best for: Professionals just out of college

NerdWallet does its best to make managing money fun, chock full of catchy phrases like “Cha-Ching” when you make a deposit and encouragement like “Nice!” when you rein in spending. Like the others, it gives you a picture of your financial health (called a Nerd’s-eye view).

When you sign up to NerdWallet it asks you if you’re looking to build credit, earn extra cash back, stay on top of spending, or want to take control of debt. Depending on your choice, it then shows you sample features related to your goals. If it’s, say, debt you want to control, the app will show you how long it will take to pay it off and in what areas you are carrying the most debt (student loan, credit card, or auto, for example). For people who have better things to think about, the program will also remind you when upcoming payments are due.

One nettlesome area of NerdWallet is its persistence in attempting to get info like social security numbers. You can add the value of your car, for example, but when you try to assess related expenses, it asks for your social security number. (It should have automatically seen car loans from the linked bank accounts without asking for the number.) The app also wants your social security number and personal information to do a debt analysis, which shouldn’t be necessary. NerdWallet also wants your social security number for periodic credit checks, which we declined–although we had to quit the program to do so (there was no “decline” or “back” button). Here’s the problem with that: After it performs credit checks, NerdWallet may share the information with its business partners to pitch you other services.

Other minor glitches include the fact that, in a list of top places we spent money last month, Nerdwallet incorrectly listed home insurance as one of the highest monthly expenses, completely missing a much more expensive regular property maintenance payment. During setup, the program also failed to accept a U.S. phone number that other apps had no problem with.

Still, for those just starting out, there’s plenty to like. There’s a MoneyFix podcast, for example, and tips for scoring luxury trips for less money. NerdWallet also offers some unique cash-back programs for restaurants that you link to your credit card. We also love the way the app breaks down spending and reveals patterns (how much you spent by a certain day this month versus last, for example).

Personal Capital

Best for: People getting serious about money

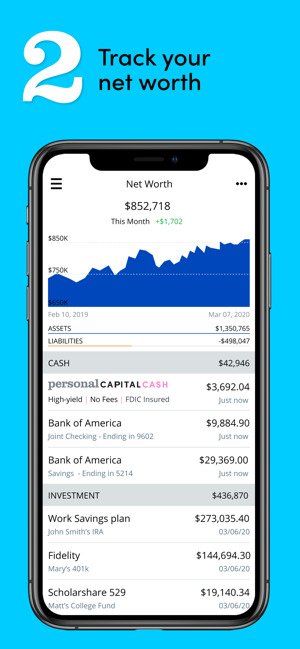

Personal Capital wins the award for a no-nonsense presentation of your fiscal situation. Once set up, it delivers a top-line net worth (assets minus liabilities) summary, a listing of all your accounts. A trending graph accompanies each category (loans may remain flat while debt is on the upswing, for example). Tap on an account and you’ll get a listing of what you’ve paid recently and the total amount you owe.

In the by-the-numbers approach you can add assets like real estate you own and your stock portfolio. Personal Capital will follow the oscillations of the stock market and your investments. You can link your portfolio via Charles Schwab, TD Ameritrade, and numerous others. If your broker isn’t on the drop-down list, you can search Personal Capital’s database for others like E*Trade. Keeping the emphasis on capital, the app also offers financial advisory services for people with portfolios of over $100,000 (for a fee, of course).

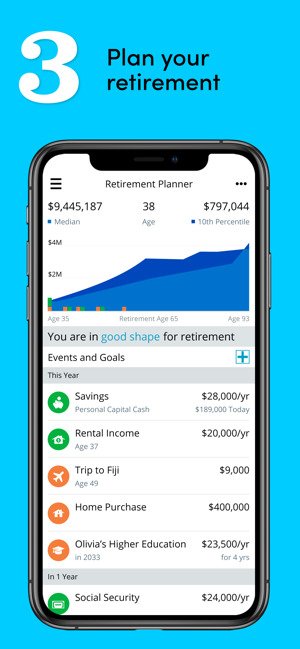

The program offers a LinkedIn-style assessment of how well you know your financial health. The more data you enter, the higher your score. It also tends to focus on the long term, including advice and help for retirement planning. On the more quotidian side, Personal Capital, like the others, offers standard budget tools, showing how much you’ve spent so far compared to last month. It also nicely breaks down categories like groceries, insurance, travel, and phone bills.

Some advice before you get started

But before you rush into one of the apps listed above, there is some advice to keep in mind.

It takes work

Some programs boast that it takes only a minute to get started. Don’t believe it. At a minimum, you have to authenticate each of your bank and credit card accounts. Anticipate more time setting up tracking if you have a mortgage or investments; and still more time if you want to add other accounts like your mobile and utility bills. Have all your personal financial information handy to speed up the process.

Consider security issues

There are always additional risks that come with sharing your passwords and account numbers with a third-party source, no matter how you look at it. Even if the company appears reliable and trustworthy, like a financial monitoring service, it’s always wise to practice a degree of caution.

Each of the three apps we reviewed take securing your personal information seriously. However, they also may share information such as your credit score with other business partners.

The only way to confirm whether your data could wind up circulating the web is by reading the fine print (and there’s a lot of it to comb through).

Don’t Share Too Much

Sharing the goals you set on social media with your friends is one of the new wrinkles of personal finance software. Sharing on social media can help motivate you to reach your goals through peer pressure (or support), whether you’re trying to reduce debt or save money for a special something.

Although it may sound like a great idea, we advise against making your financial information public. What might appear safe may actually backfire and make you vulnerable to scams like spear phishing. We recommend keeping your goals to yourself or sharing them with your trustworthy family and friends.

It Still Helps

The apps we’ve discussed in our lists can provide sound approaches to allocating funds, but only if you use them properly. Fund allocation is one of the most common struggles for people, no matter their age or background. They offer a solid combination of various investments, bills, and budget items in a single, easy to comprehend package.

A finance app can certainly offer incredible benefits to those who are beginning a new job, starting a family, or in the process of planning to purchase a house. Using one of these apps can quickly set you on the path to success. We also want to point out the importance of remembering that financial advising ads may not be the best option for you, especially since most of them do not have your best interest in mind. We suggest exercising caution and good judgment when deciding whether to trust advice or call it a scam.

You’ll also want to remember that you will need to invest the necessary time and effort to get the absolute most out of your app.