When managing personal finances, there are many tasks to remember — from budgeting and tracking expenses to saving money and investing for the future. Fortunately, technology has made it easier than ever to stay on top of your finances, and plenty of apps are available for Android and iOS users to help you manage your money effectively. This means you can use them on any of the best mobile devices on the market, including the iPhone 15 Pro and Samsung Galaxy S23 Ultra.

We have compiled a comprehensive list of our favorite apps to help you find the right personal finance app for your needs. These apps can help you track your spending, create a budget, monitor your investments, and more. Whether you’re looking to save for a big purchase, pay off debt, or improve your financial health, these are the personal finance apps you should use.

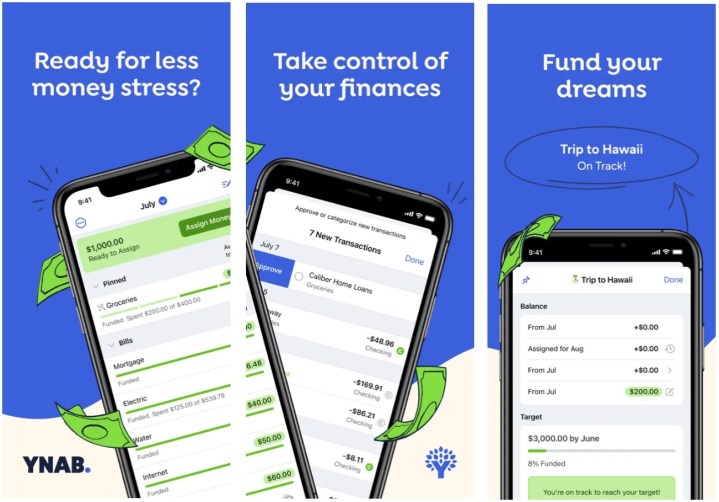

YNAB

Managing personal finance can be daunting, and many apps specialize in only one or two aspects of it. However, YNAB (You Need a Budget) is a unique all-in-one solution that allows you to track your income, expenses, and goals. It follows the envelope system of budgeting, which involves categorizing everything that goes in and out of your accounts.

With effective use, YNAB can help you better control your finances, gain insight into how to pay off your debt faster, and save money. Consequently, it can significantly reduce the stress that comes with personal finance. Furthermore, YNAB is available on Android, iOS, and desktop. While the app is free, to begin with, you will need to subscribe monthly or yearly to access all its features.

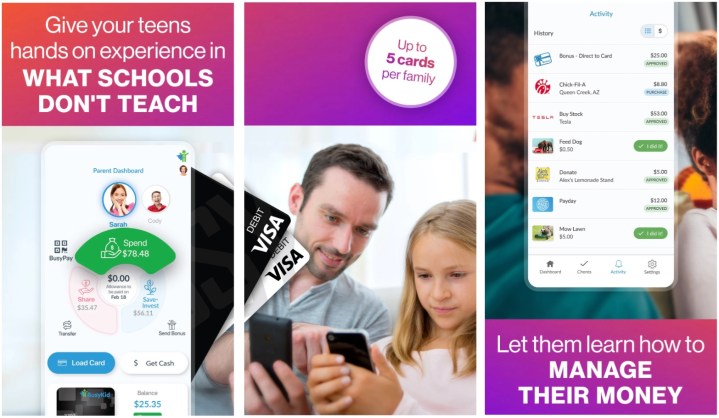

BusyKid

It’s essential to teach children about budgeting and money management from a young age. BusyKid is a helpful app that can assist parents in this process. The app has several useful features, including creating age-appropriate chore charts and setting up allowances. With BusyPay, parents can send allowance payments to their children automatically, and they can even use a BusyKid Visa Kids Debit Card for hassle-free transactions.

The best thing about the app is that it makes learning about money management valuable and enjoyable for kids. You can try BusyKids for free for 30 days. After that, it’s $4 per month billed annually. Membership allows for up to five BusyKid debit cards.

Copilot

Copilot is another comprehensive personal budgeting solution to help you handle your finances better. By connecting to your bank and credit card accounts, Copilot provides insights into your spending habits, allowing you to make more informed decisions in the future.

Copilot uses Al-powered technology to categorize your transactions, making understanding where your money is going easier. In addition to this, the app allows you to create and manage multiple budgets, track your investments, and provide visual insights and dashboards. Copilot is exclusively available for iPhone and Mac users and offers a free trial. After the trial period, users can subscribe to the service for less than $8 per month.

Empower Personal Dashboard

Managing personal finances can be overwhelming, but it becomes convenient and effortless with Empower Personal Dashboard. Empower Personal Dashboard is a free financial management tool that provides a comprehensive overview of your financial situation.

The tool lets you see all your connected bank accounts, credit cards, investment, and retirement accounts in one place. Empower Personal Dashboard features net worth tracking, budgeting, investment tracking, financial planning, and more — making it the perfect tool to manage your finances. You can access the app via the web or on your Android and iOS devices.

EveryDollar

EveryDollar is a budgeting app that is based on the principles of Dave Ramsey’s Financial Peace University. The app is designed to help you create an effective budget that suits your needs. It mainly focuses on your traditional bank accounts and is available for free with ads. However, you can unlock more features like removing ads, category customization, and more with a paid EveryDollar Plus subscription. The app provides budget tracking, financial reporting, and goal tracking and allows you to create multiple budgets.

Goodbudget

Goodbudget is a personal finance app that focuses on the envelope budgeting system. It is user-friendly and helps you keep track of your spending. Although it may not be as comprehensive as some of the other apps in this category, it’s still worth considering because of its ease of use. The app is free to use, but you can unlock more advanced features by subscribing to a monthly plan.

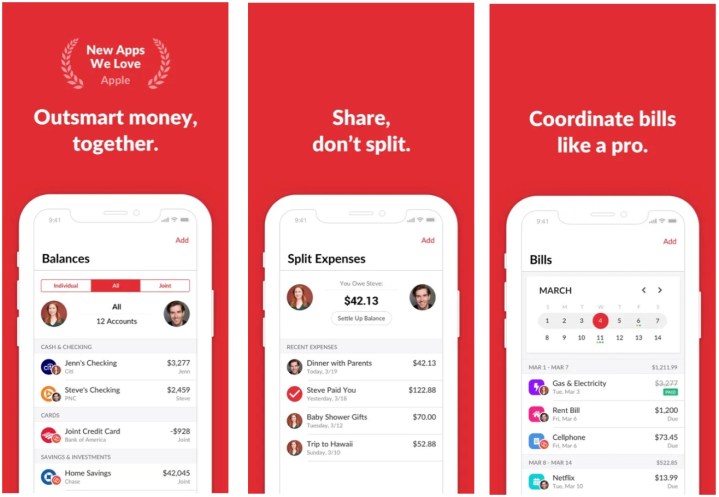

Honeydue

Effective communication is crucial in maintaining a healthy relationship, especially when it comes to managing finances as a couple. This is where Honeydue comes into play. The app offers similar features to traditional personal finance apps, such as monitoring expenses and creating budgets. However, it also serves as a platform for couples to have transparent conversations about their financial situation. Honeydue’s additional features include goal-setting, financial insights, savings tracking, and much more.

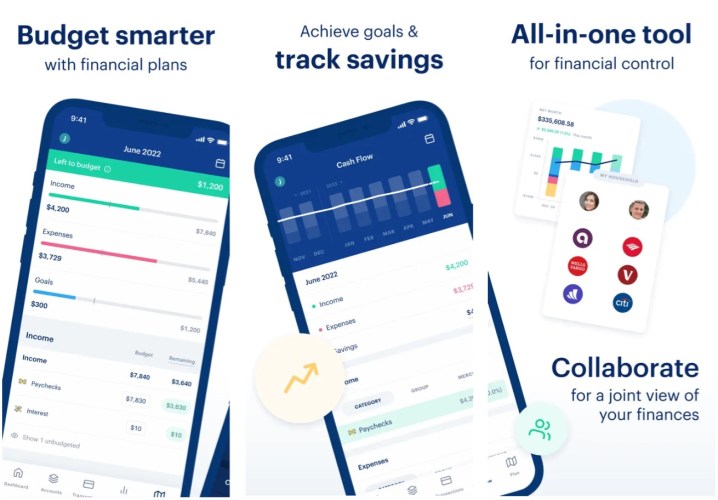

Monarch

Monarch is an excellent financial management tool for individuals and couples. The app uses zero-based budgeting to ensure that every income and expense is accounted for. It provides customizable budget tools, charts, and insights to help you manage your finances. The app also has a built-in collaboration tool, making sharing content with a partner or financial advisor easy. Monarch is available on the web and Android and iOS devices. You can try it free for seven days; subscriptions start at around $8 per month when purchased yearly.

PocketGuard

PocketGuard is an app that can help you manage your finances better and avoid overspending. With its user-friendly interface, you can easily keep track of your income, expenses, and bills. Some of its key features include real-time cash flow tracking, bill reminders, budgeting tools, and fraud detection. If you choose to upgrade to PocketGuard Plus, which starts at less than $3 per month, you’ll get access to additional features like debt payoff planning, unlimited budgeting, modified reports, and more.

Your bank’s app

If you’re looking for an effective way to manage your finances, your bank’s app might be the best solution. With real-time tracking of your banking accounts, you can easily monitor your spending and income. However, choosing the right app is essential, as not all bank apps are created equal.

Some apps may offer better features, such as the ability to connect other accounts, such as credit cards, retirement, and investing. By doing so, you can get a better overview of your financial status, which can be incredibly helpful when it comes to budgeting and planning for the future. The best part? Native banking apps are absolutely free. Check with your bank for more information.

Editors' Recommendations

- iPhone SE deals: Refurbished 2nd and 3rd Gen iPhones

- Best iPhone deals: Save on iPhone 15, iPhone 15 Pro Max and more

- 10 iPhone productivity apps you need to download right now

- Best phone deals: Save on the iPhone, Galaxy Z Fold 5, and more

- The 10 best photo editing apps for Android and iOS in 2024