Gone are the days of needing to stash your phone and your wallet in your back pocket or bag. Nowadays, there’s a convenient alternative to credit cards and cash: Mobile payment solutions. You can use a mobile wallet to pay for online transactions or use a built-in chip in your phone to pay for an in-store purchase.

Samsung Pay is the proprietary mobile wallet that you will find on newer Samsung devices. This app comes with convenient tools to manage your money and pay for purchases online and in stores. Getting started is very easy, and soon you’ll wonder how you ever managed to shop without this app.

What is Samsung Pay?

Samsung Pay is an Android app that works with specific Samsung devices, allowing them to communicate with payment terminals. Out shopping for a new dress, or picking up some coffee at your favorite cafe? You can leave your credit or debit card at home, utilizing the Samsung Pay app instead. Your smartphone can use NFC technology to pay with any terminal that supports wireless payment with a simple tap, but that’s not what makes it unique.

Not all retail stores have caught up with the times, and many are still utilizing older payment terminals that don’t support new payment technologies such as Apple Pay and Google Pay. However, Samsung goes to the next level by offering MST (magnetic secure transmission) technology in its smartphones; thus, you can pay with any terminal that accepts cards — no wireless compatibility needed. MST sends out a signal that mimics the black stripe on the back of your card, making older terminals merely think that you manually swiped your card.

How do I set up Samsung Pay?

Begin by checking you own a compatible Samsung smartphone. All Galaxy devices since the S6 and Note devices have the technology built-in, in addition to several Galaxy A devices. Many Samsung wearables also feature Samsung Pay for quick payment with your wrist — no

Once you have determined that your Samsung smartphone is compatible with Samsung Pay, follow these steps:

Step 1: Begin by opening the Samsung Pay app on your device.

Step 2: Once the application is open on your device, tap the Get Started button.

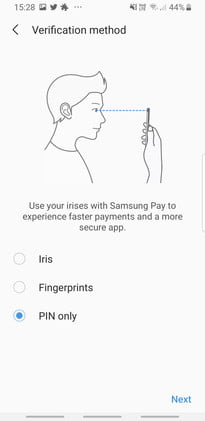

Step 3: You’ll then be given the choice of setting up the app using iris or fingerprint scanning or a PIN only. When selecting PIN only, you’ll be prompted to input a four-digit PIN that will be used in the future to protect your information — type it twice for verification.

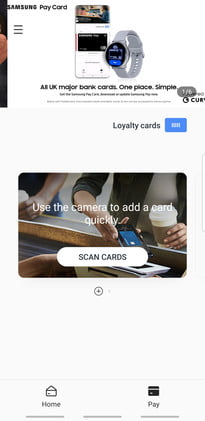

Step 4: Tap the Menu button in the top-left corner of the screen. Then, in the popup, select the Add Credit/Debit Card option.

Step 5: Follow the instructions on-screen to scan your card, complete setup, and agree to any terms and conditions. You can also add your card manually.

Step 6: The app will ask you if you want to set Samsung Pay as your default mobile payment service. To continue, select Set as Default. If you already have a default payment app set up — such as Google Pay — the app will ask you if you wish to replace this.

It is important to note that not all banks support Samsung Pay at this time. However, most credit card companies, including American Express, Visa, and MasterCard, are included. By default, the Samsung Pay app is preinstalled on Galaxy devices, but you can easily reinstall it if it was removed at some point.

Adding Samsung Pay to your smartwatch

If you have a compatible Galaxy Wearable device, you can add Samsung Pay for secure payments on the go. However, it is essential to understand that wearable devices only support NFC. As MST is not supported on Galaxy Wearable devices, you will need to use a pay terminal that supports contactless payments. Fortunately, the newer Samsung Galaxy Watches make setup very simple.

Step 1: Begin by pressing and holding the Back (top) button for a couple of seconds. It may take a few seconds for Samsung Pay to start if it’s your first time using it.

Step 2: Tap the arrow to begin setting things up.

Step 3: On your phone, tap OK to open Samsung Pay, then tap Start. You may need to sign into your Samsung account.

Step 4: Tap the three dots on your watch, then tap + Add Card to add your card. You can tap Turn On to set up a lock screen for your watch, which we recommend doing if you haven’t already.

Step 5: Enter a four-digit PIN on your watch, and type it twice for verification. You can now start adding your payment cards.

Step 6: If you have an older Samsung smartwatch, you'll have to go to the Samsung Pay app in the Home tab to get started, then choose the plus symbol to add things. This isn't as common these days, but it's not hard to begin.

Step 7: Once Samsung Pay is entirely set up on your Galaxy Wearable, you’ll be able to pay for transactions using your smartwatch, as well as view any recent purchase that may have been made through the service. Note that the watch and smartphone will only show transactions that have been made on their hardware — they are not shared between devices.

Paying with Samsung Pay

Galaxy Smartphone: Out shopping and ready to pay? You will be prompted to select the card you want to use, and after verifying your identity, you will then be told to place the back of your Samsung

Galaxy Wearable: Launch Samsung Pay by holding the back key once the app is ready on your Galaxy Wearable device. Then select the card you want to use and tap the Pay button. Tapping the wearable to the terminal just like you would if paying with your smartphone will complete the transaction.

Other Samsung Pay options

It's a good idea to look in your area and see how else you can use Samsung Pay's wallet. Various transit services may accept it, and Samsung is rolling out the option to store your vaccination records on the app as well. It can do a lot more than just mimic your credit card.

Is Samsung Pay safe to use?

Now that you know how to set up Samsung Pay, your next question might be whether it’s safe to use the service daily. Fortunately, the answer is yes. Your Samsung device doesn’t store any of your personal or financial information, first of all. Secondly, your secure PIN or biometric data such as a fingerprint or iris scan keeps the information on your Samsung smartphone or wearable secure, keeping it safe if the wrong person gets ahold of your device.

You can use Samsung’s Find My Mobile feature to quickly locate your device if you lose it, and the Lock my screen function will keep the device locked down to prevent the use of services such as Samsung Pay.

Editors' Recommendations

- Today’s Galaxy Tab S9 deal: $100 off and free Buds 2 Pro

- Best Samsung Galaxy Z Fold 5 deals: discounts and trade-in credit

- Galaxy AI is coming to more Samsung phones very soon

- Samsung Galaxy Watch 7 Ultra: news, rumored price, release date, and more

- 5 phones you should buy instead of the Samsung Galaxy S24 Plus