- Home

- Mobile

Mobile

About

Mobile and smartphone news, reviews, and discussion for everything from Android to iPhone and every accessory and app you could ever use.

The best tablets in 2024: top 11 tablets you can buy now

Learn 14 languages: Get $449 off a lifetime subscription to Babbel

Something odd is happening with Samsung’s two new budget phones

How to view Instagram without an account

The first HMD Android phones are here, and they’re super cheap

Apple is about to do the unthinkable to its iPads

The best iPads in 2024: the 5 best ones you should buy

Best refurbished iPhone deals: Get an iPhone 14 for $513

Best Samsung Galaxy Z Fold 4 deals: Grab the foldable phone for $700

AirTags range: here’s how far the tracker can reach

Best Verizon new customer deals: Galaxy S24, iPhone and more

One of the biggest Oura Ring competitors just did something huge

We finally know when Apple will announce its 2024 iPads

Nomad’s new iPhone case and Apple Watch band may be its coolest yet

OnePlus surprises us with dazzling Android tablet and smartwatch

Every Android tablet we’re expecting in 2024

Is the Oura Ring waterproof?

Best Samsung tablet deals: Discounted tablets as low as $184

Best Apple Watch deals: Series 9 and Ultra 2 discounted

Best Samsung Galaxy S22 deals: Save big on unlocked models

An Apple insider just revealed how iOS 18’s AI features will work

Best iPhone deals: Save on iPhone 15, iPhone 15 Pro Max and more

I reviewed the Samsung Galaxy A55. It didn’t go as expected

Mobile News

Android

Wearables

Apps

As much as we love having the best smartphones in our pockets, there are times when those small screens don't cut it and we just need a larger display. That's when you turn to a tablet, which is great for being productive on the go and can be a awesome way to unwind and relax too. While the tablet market really took off after the iPad, it has grown to be quite diverse with a huge variety of products — from great budget options to powerhouses for professionals.

We've tried out a lot of tablets here at Digital Trends, from the workhorses for pros to tablets that are made for kids and even seniors -- there's a tablet for every person and every budget. For most people, though, we think Apple's iPad Air is the best overall tablet — especially if you're already invested in the Apple ecosystem. But if you're not an Apple user, that's fine too; there are plenty of other great options that you'll find in this roundup.

Looking for some sweet tablet deals? Check out our lists of the best iPad deals, and the best tablet deals.

Apple iPad Air (2022)

The best tablet overall

- High-performance M1 processor

- Slim and light

- Software suitable for work or play

- Large, colorful, and sharp screen

- Wide array of quality accessories

- Center Stage works well

- 64GB storage isn't enough

- Battery life disappoints

Why should you buy this? The iPad Air (2022) offers almost everything you'll get from the iPad Pro, but at a lower price.

Who's it for? Anyone who wants a great tablet at a good price.

Why we picked the iPad Air (2022):

While it's far from the cheapest tablet on the market (check out the basic iPad for our best value pick), at $600, the iPad Air still gives you excellent value for money — especially if you're looking to go a bit beyond the basics. It features a much more attractive design than most of its competitors and offers many features that are close to or even identical to those found in the much more expensive iPad Pro lineup. The iPad Air (2022) is our pick as the best tablet you can buy right now.

Performance is a particular draw on this tablet. Apple has slung in the laptop-level M1 chip, the same processor from the 2021 iPad Pro series and the MacBook Air (2020). It's a monster of a chip, and you're unlikely to encounter anything that'll slow it down, including video editing. Performance-wise, this is a tablet with enough power to take on a laptop, and it shows.

Combined with the powerful iPadOS software, this means the iPad Air can do well at being a laptop replacement. The Magic Keyboard is an expensive addition, but it turns your iPad Air into a laptop-like device — and a pretty good one at that. Since it's all on the same software, it also plays nice with iOS devices like the iPhone 15 and iPhone 15 Pro, it that cross-device support allows you to do things like taking calls on your iPad. There's also support for the second-generation Apple Pencil, making this a good choice for drawers, typers, and tappers alike.

The design is similarly high level. The slim bezels aren't too small to grab properly, and the weight and comparatively compact 10.9-inch display mean it's still comfortable to hold. Sure, it's the same design as the previous iPad Air, but that's because there's nothing wrong with the look of that tablet. Unfortunately, it does lack the faster 120Hz ProMotion display from the iPad Pro, which you might notice if you're used to using a screen with a higher refresh rate. However, that's not going to bother you if you're accustomed to the much more standard 60Hz found on most tablets and laptops.

The cameras are really quite good for a tablet, and the 12-megapixel front-facing camera particularly stands out. Center Stage keeps you in the middle of the frame, even if you move around, and expands the view when friends and family join you. While you're unlikely to be taking a lot of pictures with the rear camera, it's still got the goods when you need it.

It's certainly not cheap, but if you can stretch to $600, then this is our overall recommendation for a strong tablet that can handle a wide range of tasks and needs. Want an Android-based equivalent, something a bit cheaper, or something even more powerful? Keep reading for more options.

OnePlus Pad

The best Android tablet

- Bold and unique design

- Fun green color

- Sharp and vibrant LCD display

- Up to 144Hz refresh rate

- Gets 3 years of Android upgrades

- Fast performance

- Low-quality cameras

- Odd placement of the rear camera

- Some software quirks

Why should you buy this? It's the best that Android tablets have to offer.

Who’s it for? Anyone who needs a medium-sized tablet with creative, professional, and casual options.

Why we picked the OnePlus Pad:

While most Android tablets look the same, the OnePlus Pad, like the OnePlus 12, stands out from the crowd. The brushed metallic back in a rich and lush green color is definitely a unique design, especially with that camera placement, and it will surely turn heads.

The 11.61-inch LCD display has a 2800 x 2000 pixel resolution and an interesting 7:5 aspect ratio that works well. It also has 500 nits of peak brightness and an impressive refresh rate of up to 144Hz. The 144Hz refresh rate is reserved for specific apps, however, so most of the time you'll experience it in 120Hz. The display, even though it's not an OLED, still offers bright colors, sharp and crisp text, and the scrolling is smooth. Plus, it has support for Dolby Vision and Dolby Atmos surround sound, making it great for entertainment. Simply put, it's an excellent viewing experience.

On the inside, the OnePlus Pad has a MediaTek Dimensity 9000 chip, 8GB RAM, and 128GB storage. Though it's not a Snapdragon 8 Gen 2 chip, the Dimensity 9000 is still very capable in terms of performance. The OnePlus Pad comes with OxygenOS 13, which is OnePlus' custom interface that is based on Android 13. With its internal components, the OnePlus Pad is also able to run up to 24 live apps at once, so it's a multitasking king. And even if you don't run 24 apps at once, the OnePlus Pad handles everything smoothly and efficiently.

For cameras, you get a 13MP rear shooter and an 8MP front camera. It's not the best camera setup in the world, but it's good enough for document scanning and video calls. It's highly doubtful you'll be taking any tablet out and about for shooting all of your photos with — that's where the best camera phones come in.

Battery life with the OnePlus Pad is also outstanding. It has a 9,510mAh battery cell inside, which can last for up to 12 hours for consecutive video watching. It also lasts about one full month on standby, and if you don't have accessories connected or background apps running, it can last up to 50 days. Charging it up is fast, too, with 67W charging, so it goes from zero to 100% in about 80 minutes. With average use, this should last a few days at least.

The OnePlus Pad offers a lot of power and efficiency for a good price. The unique color and design will also make you stand out.

Apple iPad (2021)

The best value tablet

- Great battery life

- Powerful internals

- Big upgrade to the front-facing camera

- Amazing software support

- Base storage more acceptable at 64GB

- Display doesn't get bright enough

- Lightning port in 2021

- Slow Touch ID sensor

Why should you buy this? It's simply the best value tablet you can buy.

Who’s it for? Anybody who wants a tablet that can handle all the basics, without spending too much money.

Why we picked the Apple iPad (2021):

The iPad (2021) is no longer the latest iPad, thanks to the release of the more expensive iPad (2022), but there's a reason Apple left this older model on the market. At $329, it still offers the best value for folks who need a tablet that can handle all the basics and more at a very affordable price.

It's the tablet world's "ol' reliable" — if you want a tablet without the frills at a great price, you want the basic iPad. Don't take the word "basic" to be an insult, either. The iPad (2021) is an excellent performer, has a 10.2-inch display, long-lasting battery life, and probably the best tablet software you can get. Yes, the design is quite dated, but don't let that fool you — there's a lot of power packed in under the hood.

We'll start with the internal specs. The iPad is, admittedly, equipped with an older processor, but it's an old flagship processor, and that makes a difference. Specifically, the A13 Bionic chip was the silicon that powered the iPhone 11 lineup, and it remains a powerful piece of kit despite its age. This processor should be able to easily handle any games you throw at it and should be purring along nicely for years to come. The other improvement is the installation of 64GB of internal storage as standard, giving you a lot more room to play with.

The iPad has also seen a significant improvement in front-facing camera tech. Goodbye paltry 1.2MP lens, hello 12MP lens. Removing a single period has made all the difference, and now the iPad actually has a selfie camera worth doing video calls with, and the auto-framing tech is pretty cool as well. Battery life is also excellent, though that's less of a worry when most people's tablets tend to live near outlets anyway.

Best of all, this iPad starts at just $329. That's an incredible bargain, and there's nothing on the Android side of the fence that comes close to approaching this tablet in terms of pure value. If you want something capable, but don't need something with more power than your average desktop computer, then the iPad (2021) is easily the best choice around.

Amazon Fire Max 11

The best value Android tablet

- Great screen for video

- Keyboard feels good to type on

- 10-hour-plus battery life

- Useful kickstand case

- Sparse app store

- Slow charging

Why should you buy this? It's an affordable Android tablet that will give you the best bang for your buck.

Who’s it for? Folks looking for an affordable Android tablet that handles all the basics well.

Why we picked the Amazon Fire Max 11:

The Amazon Fire Max 11 is a basic little tablet that will get the job done if you are on a tight budget. Design-wise, the Fire Max 11 isn't going to be a standout in any way, but that's fine. The 11-inch size, combined with the simple design, makes it lightweight and incredibly easy to use.

The MediaTek MT8188 octa-core processor is not the absolute best out there, but it handles basic tasks and even casual games just fine. It also has 4GB of RAM, so it's not going to be able to handle super-intensive tasks, but if you need something with more power, then you wouldn't be looking at something this cheap either. For the average person, the specs of the Fire Max 11 are fine for general use.

Plus, this Amazon Fire Max 11 can be used with separate accessories, like a keyboard and stylus, making it a fantastic value if you want to be more productive.

However, the Fire Max 11 won't come with the Google Play Store by default — you'll have to add that manually later on. The Fire Max 11 uses a version of Fire OS that is based on Android 11, so it's a little outdated. It comes with Amazon's own curated app store, so the app choice may be a bit more limited than other Android tablets. But there are ways to get the Google Play Store on the Fire Max 11.

The Amazon Fire Max 11 is far from perfect. Software and app availability are a bit disappointing, and the separate stylus has limited use (it doesn't come with a sketching app by default). It has a 7,500mAh battery that's decent, but the included charging block has a max charging speed of 9W. The Fire Max 11 only supports up to 15W of charging anyway, so even if you use a faster charging brick, it will take around three hours to get a full charge — you better not need to charge up before you head out!

But with battery life being around 10 hours, it should be fine for a full workday, then just charge it up overnight. For the price, the Fire Max 11 is a pretty strong value.

Apple iPad Mini 6

The best small tablet

- Big enough to perform most tasks

- Compact enough to travel easily

- Powerful performance

- Loud speakers

- USB-C

- Screen is not bright enough

- Too small for content creation

- No headphone jack

Why should you buy this? You want a great tablet with a smaller footprint.

Who’s it for? Anyone who wants a smaller tablet.

Why we picked the iPad Mini (2021):

It took a while for Apple to update the iPad Mini the last time it got refreshed, and it's taken a similarly long time to update the iPad Mini's appearance as well. Thankfully, the wait is at an end, and the new iPad Mini (also known as the iPad Mini 6) has arrived. The new design is now in line with the other premium iPads, meaning the iPad Mini is now finally a smaller version of the iPad Air and iPad Pro.

It doesn't match the new iPad Air (2022) where specs are concerned, but it comes pretty close. The iPad Mini packs in the A15 Bionic processor — the same chip that's still used in the iPhone 14 and iPhone 14 Plus — and while that's not a match for the new Apple M1 and M2 chips found in the more expensive iPads, it doesn't need to be. The A15 will devour any games you'll want to play, and you're unlikely to need the oomph the M1/M2 provide for content creation apps, because, well, the iPad Mini is too small to work well as a content processing machine anyway.

Does that make it a bad choice? Absolutely not. In fact, the smaller size and the A15 chip are the only differences that set the iPad Mini (2021) apart from the iPad Air (2022). In every other way, it's really just a smaller version of that best overall tablet. You get the laminated display with an anti-reflective coating, 5G support, a 12MP front camera with Center Stage, a Touch ID sensor in the side button, and much more.

It's supremely portable, stupidly powerful, and an excellent choice if you need something that leverages these strengths. The battery also lasts around a day and a half of use — the same as the iPad Air (2022) — so it's a great choice for taking out and about, and it also pairs up with the second-generation Apple Pencil as well.

While the pint-sized iPad isn't likely to be everyone's cup of tea, the iPad Mini is an excellent choice if you're looking for a smaller tablet to carry around. While the smaller size means it won't work with Apple's Magic Keyboard, you can pair it with any Bluetooth keyboard and mouse to turn it into an ultra-portable workstation or just use it for watching videos, reading books, or whatever else you need on the move.

Apple iPad Pro (12.9-inch)

The best big tablet

- Sleek and modern design

- Bright, vivid, gorgeous display

- Wild performance from the M2 chip

- Apple Pencil hover feature

- iPadOS 16 is super robust

- Stage Manager needs more work

- Lackluster, awkward front camera

- Prohibitively expensive

Why should you buy this? The iPad Pro is extremely powerful and offers a huge screen.

Who’s it for? Gamers, creatives, and power users.

Why we picked the iPad Pro (12.9-inch):

There's a new iPad Pro in town, but the game hasn't changed. This is still the biggest and most powerful tablet around and it's perfect for all kinds of uses. Not only is the iPad Pro (12.9-inch) the best tablet for multimedia and gaming, but it's also the best tablet for drawing. The device offers a nice big edge-to-edge display that's perfect for watching movies, studying, gaming, and so on. The bezels are slim and the home button has been replaced by Face ID. Apple has also adopted USB-C, which gives you far more to choose from in terms of accessories and peripherals.

The iPad Pro sports one of the biggest and best screens around, with a 2732 x 2048-pixel resolution and Apple's Liquid Retina XDR display tech, the tablet offers an incredible display experience all around. The Liquid Retina XDR display means that the iPad Pro leverages Mini LED for super deep black levels and tons of brightness, plus there's a 120Hz refresh rate — making the tablet perfect for games.

The latest iPad Pro comes with an M2 chip, which the iPad Pro performs about as well as the newest Mac devices. Power users shouldn't run into the device's limits, whether you're commanding armies in Civilization VI or editing an image in Photoshop. The iPad Pro can cope with any game or drawing app you throw at it.

Storage options aren't as good, though, as it starts at 128GB. It does go up to 2TB, but you have to pay a lot for a large capacity. There's no microSD card support, too, so unless you're big into iCloud, the amount of storage you buy is what you'll get.

Apple claims you'll get 10 hours of mixed-use from a full charge, which didn't stack up in our tests. An intense day with over five hours of screen time saw the iPad Pro sink to 16% by the end of the day. A less intense day meant the iPad Pro could probably last a second day, but if you're using this device for work, expect to reach for the charging cable.

It's expensive, especially if you need a lot of storage, and there's no headphone jack, but the 12.9-inch iPad Pro is still your best bet if you're a power-user that wants the best you can get.

Samsung Galaxy Tab S9 FE Plus

The best big Android tablet

- Very competitive price

- Water and dust resistance

- Long-lasting battery life

- Bright, vibrant display

- S Pen included for free

- Android software brings it down

- Bulky and heavy

- Refresh rate is disappointing

Why should you buy this?: You get a lot for much less than most of the competition.

Who's it for: Anyone who wants a lower-cost tablet that's still offers a huge display should consider this.

Why we picked the Samsung Galaxy Tab S9 FE Plus:

The Samsung Galaxy Tab S9 FE Plus is an affordable large-screen tablet that offers many of the same features as its more expensive counterpart, the Samsung Galaxy Tab S9 Plus. It's a great option for those who want a budget-friendly tablet. The tablet boasts an impressive battery life of over 20 hours on a single charge, making it the perfect complement to a large Samsung phone, like the Samsung Galaxy S24 Ultra.

The AKG-tuned dual speakers of the tablet deliver crystal-clear sound, making it perfect for listening to audiobooks and podcasts. The audio output of the tablet is remarkable, as mentioned in our review.

The Galaxy Tab S9 FE Plus is powered by a Samsung Exynos 1380 CPU and Arm Mali-G68 GPU, which provides decent mid-range performance. While the tablet may struggle a bit when opening multiple apps simultaneously, the overall performance is good.

The tablet boasts a remarkable 12.4-inch WQXGA display with a resolution of 2560 x 1600, which provides an excellent visual experience. Despite not being an AMOLED panel, the display is sufficient for most users. However, due to the 90Hz refresh rate, fast scrolling on websites may cause stuttering, and mobile gamers may experience issues while playing games with a lot of movement.

Overall, the Samsung Galaxy Tab S9 FE Plus is a fantastic large-sized tablet that offers excellent value for your money.

Lenovo Tab Extreme

The best productivity tablet

- Beautiful 3K OLED display

- Immersive speakers

- Comes with stylus

- Has two USB-C ports

- Capable performance

- Good value

- Size can be unwieldy

- Magnets on back for stylus not great

- Multitasking quirks

Why should you buy this?: This is one of the biggest and most powerful Android tablets on the market right now. It's size will make you a master of productivity.

Who's it for?: Anyone who wants the largest tablet available to replace a laptop.

Why we picked the Lenovo Tab Extreme:

The Lenovo Tab Extreme looks like other Lenovo tablets on the market, like the Tab P11 Gen 2, but it is much larger and more expensive. If that's what you're looking for, then take a look at the Lenovo Tab Extreme, our choice for best productivity tablet.

The Lenovo Tab Extreme has a massive 14.5-inch OLED 3K display that has an 1876 x 3000 resolution with a 16:10 aspect ratio and 224 pixels per inch (ppi). It also supports HDR10+ and Dolby Vision and has a refresh rate of up to 120Hz. With the eight JBL speakers that support Dolby Atmos, the Lenovo Tab Extreme is a fantastic multimedia machine.

Lenovo put a MediaTek Dimensity 9000 chip inside with 12GB RAM and 256GB storage. It ships with Android 13 out of the box but also has Lenovo's ZUI software on top. Overall, the Lenovo Tab Extreme is very capable when it comes to power and performance, and the ZUI interface allows for super easy multitasking, with up to four split-screen apps running at once, with more floating windows if needed. If you need a big Android tablet that can handle all of your multitasking with ease, then the Lenovo Tab Extreme is the tablet for the job.

Like most tablets though, the camera system isn't super impressive. You have a 13MP main camera with a 5MP ultrawide depth sensor and a flash, and the front-facing camera is 13MP. It's all fine for video calls and document scanning, but don't expect fantastic shots outside — the weight also makes it a bit cumbersome to move around a lot anyways.

Battery life is impressive with a 12,300mAh cell inside. If you use it for a few hours a day, it should last around two days at least. It does get about 12-13 hours of use with continuous video playback. The charger it comes with is 68W, so it takes about two hours to get a full charge. Reverse wireless charging is supported, so you can use the large exterior back to charge up smaller phones and even wireless earbuds.

The Lenovo Tab Extreme is not cheap, but it does come with the Precision Pen 3 stylus. And if you really want to make it a laptop replacement, there's a separate keyboard case that also has a standalone kickstand flap. It's a big and expensive package, but if that's what you're after, it's the best of its kind.

Lenovo Tab M10 Plus (Gen 3)

The best affordable tablet

- Solid battery life

- Good horizontal-focused design

- Lightweight

- Low price

- Camera is often hit-or-miss

- Overall lack of processing power

Why should you buy this?: For the price point, the Lenovo Tab M10 Plus (Gen 3) has a simple and clean design, long-lasting battery life, and it can handle most basic tasks that you may need to do on the go.

Who's it for?: If you're on a tight budget but want the most bang for your buck, then this is a great option.

Why we picked the Lenovo Tab M10 Plus (Gen 3):

The Lenovo Tab M10 Plus (Gen 3) features a simple and clean design that leans towards landscape orientation use. You'll find the camera is located along the longer edge, and the buttons are in the upper left when you hold it horizontally. Even if you typically don't use tablets in landscape orientation, you'll find this to be comfortable to hold.

You'll get a sharp 2000 x 1200 2K resolution display, which is higher than other tablets that you'll typically find in this price range. The 10.6-inch IPS display is especially great for reading, note-taking, streaming video, and showing off high-resolution photos.

The MediaTek Helio G80 octa-core processor isn't the most high-end chipset out there, but it has enough power to handle the most basic tasks that you may need to do on the go. So if you just want a tablet for streaming video, note-taking, email, and social media, then this is a fantastic choice. But keep in mind that if you need more resource-intensive apps, like Photoshop, then that's where the performance may stutter a bit with the lower-end processor.

Lenovo put 8MP cameras on the front and rear of the tablet, and they aren't anything to write home about. However, if you do need to take some photos in a pinch, or do video conference calls, then they should work fine. The Lenovo Tab M10 Plus (Gen 3) comes with Android 12 equipped, and though no date is given, Android 13 will be coming as an upgrade later.

You'll find an impressive 7,700mAh battery on the Tab M10 Plus, which should last at least 12 hours on typical use. But if you lower the brightness and aren't putting it to its limit, then you should get a few days of use on a single charge, which is nice. But keep in mind that because of the large battery, charging it up from zero to 100% can take a while.

For the price, the Lenovo Tab M10 Plus (Gen 3) is a great value. You get a sleek design, good performance, and long battery life for around $200.

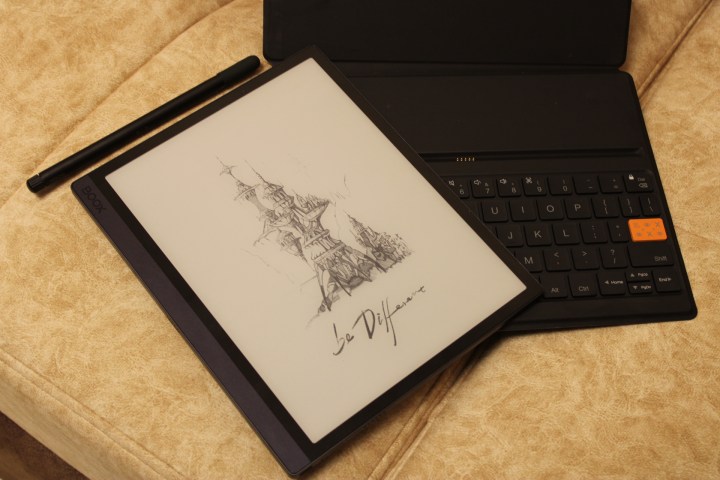

Onyx Boox Tab Ultra

The best e-ink tablet

- Big anti-glare display with a matte finish

- Fast for an e-ink device

- Excellent battery life

- Brilliant keyboard case

- Comes with a stylus

- Expensive

- Keyboard is sold separately

Why should you buy this? This is a unique tablet in the fact that it runs Android but also has an e-ink display. It makes a great e-reader, browsing device, and even a sketchbook or notebook.

Who's it for? Anyone who wants an Android tablet that is unlike anything else on the market.

Why we picked the Onyx Boox Tab Ultra:

The Boox Tab Ultra is an Android tablet that's unlike pretty much every other Android tablet on the market right now. If you're looking for a full-fledged tablet that lets you watch videos or do professional sketches, then this isn't the tablet for you. But if you want an Android tablet with an e-ink display that makes it perfect for reading e-books and articles, browsing the web, and even writing and basic sketching, the Boox Tab Ultra is for you.

Onyx's Boox Tab Ultra is composed of aluminum, so it feels solid, but it's a bit hefty with a 0.26-inch thickness and 480 grams of weight. It's not super lightweight like a Kindle, for example, but that's because this is more than just an e-reader. There are speakers on the Boox Tab Ultra, but no volume buttons — you'll do that either through software or the keyboard. There's only a power button that also works as a fingerprint sensor.

The display is a 10.3-inch e-ink display that will deliver rich contrast with deep blacks. Its anti-glare matte coating helps you see and read in bright conditions. And while the Boox Tab Ultra has a 16MP camera on the back, it's basically only used to scan documents.

The Boox Tab Ultra is powered by Qualcomm's Snapdragon 662 chip, has 4GB RAM, and 128GB storage that you can expand with a microSD card. While this may not look too impressive compared to other regular Android tablets, it is quite powerful for an e-ink tablet. Though it is running Android 11, it has a heavily-skinned Boox software layered on top, so you won't notice it too much. Again, this may be slow compared to other regular Android tablets, but this is the fastest e-ink tablet that we've tried so far.

You get the Pen 2 Pro stylus with the Boox Tab Ultra, but there is also a separate keyboard accessory that you can purchase for $110. This is optional, of course, but if you plan to use the Boox Tab Ultra for writing and note-taking, then it's worth the extra cash. The keys feature good travel and are evenly spaced out. While there's no real latency with the keyboard itself, since the display is e-ink, you will have a slight delay because of the refresh rate of e-ink displays. The keyboard has no trackpad, though, so you'll have to use your finger to scroll and navigate. The keyboard also doubles as a leather cover to keep the Boox Tab Ultra safe and protected.

The Boox Tab Ultra has a steep price tag for something that may be for a niche audience. But if you're in the market for an e-reader or e-ink tablet, then this is simply the best one to get.

Samsung Galaxy Tab S9 Ultra

The best overkill tablet

- Stunning 14.6-inch display

- Loud, rich speakers

- Excellent performance

- Very good battery life

- Water and dust resistance

- It's. So. Heavy.

- App optimization issues

- Outrageously expensive

- Pricey, necessary accessories

Why should you buy this?: If you want the absolute best tablet out there for productivity, entertainment, and gaming needs.

Who's it for: Anyone who wants the biggest tablet possible.

Why we picked the Samsung Galaxy Tab S9 Ultra:

Most people won't need the Galaxy Tab S9 Ultra. In fact, it's what we would call overkill for most people. But if you want the biggest and best tablet out there, then you can't go wrong ... as long as you can afford it.

The Galaxy Tab S9 Ultra is large; it features a stunning 14.6-inch AMOLED display with 2960 x 1848 resolution and 120Hz refresh rate with HDR10+ support. It's absolutely beautiful to look at, and everything you put on the screen will be bright, vivid, sharp, and crisp.

Inside is a Snapdragon 8 Gen 2 chip, so it offers blazing-fast performance and efficiency. Combined with the 16GB RAM, this is definitely a powerhouse. Whether you're just doing basic mundane tasks, switching between apps, playing games, or doing everything at once, this tablet can handle it all.

It also has a 11,200mAh battery inside, which means it will last around two full days, depending on usage. It has 256GB internal storage that you can even expand with a microSD card, so this is really made to be an all-around tablet for everything.

Unfortunately, the large size is also a double-edged sword. While it's great for showing so much content on the screen at once, the sheer size of it is uncomfortable to hold because it's so big. If you don't mind that though, then yeah, it's a great tablet.

Frequently Asked Questions

You must consider several factors when you’re in the market for a tablet. One of the most critical factors to take into account is the operating system. However, beyond this, you’ll also want to consider the display size, resolution, and type. The display quality is paramount and can make a significant difference in the clarity and crispness of images.

The tablet’s processor and RAM are also critical factors in determining your tablet’s overall performance and speed. Beyond this, look at connectivity and battery life. Consider the connectivity options you require in your tablet – whether you need Wi-Fi or Wi-Fi Cellular models, Bluetooth, and other ports like USB-C, HDMI, and microSD. Battery life is crucial if you use your tablet on the go or away from a power source.

And then there is storage. The more storage you have, the more apps, media files, and documents you can store directly on the device. Consider the storage capacity and whether it is expandable through microSD cards or other options.

In some respects, the most crucial factor is considering your budget and how much you are willing to spend. There are tablets for every budget – from cheaper models to high-end options.

If your top consideration is entertainment, and you’re likely to use a lot of apps and games, then we recommend Apple’s iPadOS over Android. There are a lot of polished apps made specifically for the iPad and you have access to all the top subscription services and an extensive content store. It’s also slick and accessible, so anyone can come to grips with it quickly.

Android has a larger selection of free apps and games, though they’re generally less polished, which might be a trade-off you’ll accept. Things are a little complicated by manufacturer UIs, or in the case of Amazon, forked versions of the platform. They can delay Android updates and make the user experience quite different. Amazon’s tablets, for example, run a version of Android called Fire OS and they initially only have access to the limited subset of apps and games that are available in the Amazon Appstore, not the full list that you’ll find in Google’s Play Store.

If you like the idea of accessing the same apps you have on your Windows PC, and you want a business device that ties seamlessly into your Microsoft services, then a tablet running Windows 11 is going to be tempting. It’s powerful, but it’s also relatively expensive to get decent hardware for a good user experience. If you’re not a business user, or you don’t need to run Windows-only apps, it may be overkill.

Yes, you can indeed print from a tablet. Check out our guides on how to print from an iPhone and how to print from an Android tablet for all the details you need.

Yes, you can make phone calls on a tablet, but you will need to be connected to the internet. You can either connect to Wi-Fi, which every tablet can do for free, or if you need to make calls while you're out and about beyond the reach of a Wi-Fi network, buy a tablet with cellular support and space for a SIM card. Just bear in mind if you go the SIM card route, you will also have to sign up for a service plan of some kind. Some carriers offer special plans for tablets, but keep in mind that most tablets — and all of Apple's iPads — only support a SIM card for data use, not traditional cellular calling or even SMS/MMS messaging.

You can use FaceTime on an iPad, but there are lots of good alternative video chat apps that work with Android tablets or iPads. Many of them allow you to make audio calls as well. However, the person you want to call usually has to have the same app. Some apps, like Skype, also allow you to call regular landline or mobile phone numbers, but you'll generally have to pay per minute or get a subscription. A good app that will work on Android tablets or iPads that gives you a free number for calling, text messages, and voicemail is Google Voice, but it only works in the U.S.

If you're interested in this option for a business, then you might also consider one of the best VoIP (Voice Over Internet Protocol) services.

Yes, you can send text messages from a tablet. If you have an iPad then you can use iMessage, which can connect to your phone to send standard SMS messages and iMessages alike. There are lots of great text messaging apps that work on Android or iOS. You could also use Google Voice if you are based in the U.S. as it gives you a free number for calls and text messages.

How we test

The tablets we test serve as our daily drivers, so we use them extensively to put them through their paces. That means watching movies, gaming, testing out lots of apps, reading, working on them, and even taking photos and shooting videos with them (which is impossible to do without looking stupid). We love new, innovative features, but we can also appreciate classic design done well. Ultimately, we look for tablets that will fulfill the needs of most people, so their ability to serve up entertainment is paramount.