- Home

- Computing

Computing

About

News, reviews, and discussion about desktop PCs, laptops, and everything else in the world of computing, including in-depth buying guides and daily videos.

The 6 best iPad alternatives in 2024

The new iPad Pro would be perfect, if only it were a Mac

Best laptop deals: Save on the Dell XPS 14, MacBook Pro 16 and more

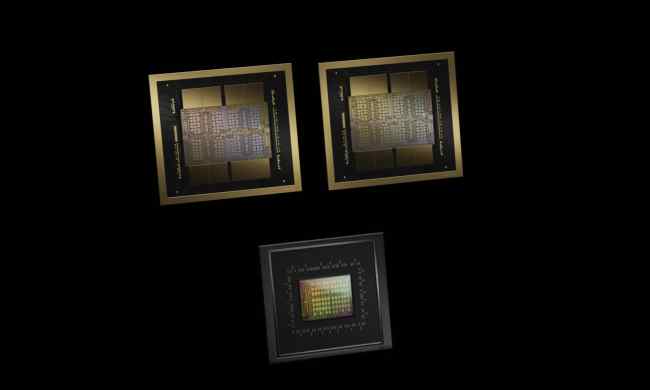

Nvidia could flip the script on the RTX 5090

Best Lenovo laptop deals: Save on Yoga and ThinkPad laptops

A new standard is raising the bar for HDR on PC

Here’s why M4 MacBooks were a no-show — and when they’re coming

M4 chip: here’s everything we know about Apple’s latest silicon

Apple did the unthinkable with the new M4 chip

Acer Swift Go 14 review: a fast but flawed laptop

This simple app was a surprising upgrade to my gaming PC

Do you need antivirus software on a Chromebook?

Best VPN deals: Save on NordVPN, ExpressVPN, and Surfshark

Save $450 on this 17-inch HP gaming laptop with an RTX 4060

Best printer deals: 10+ cheap printers on sale as low as $79

Get $1,100 off this Alienware gaming PC with RTX 4090, 64GB of RAM

Usually $390, this HP 2-in-1 Chromebook is discounted to $270

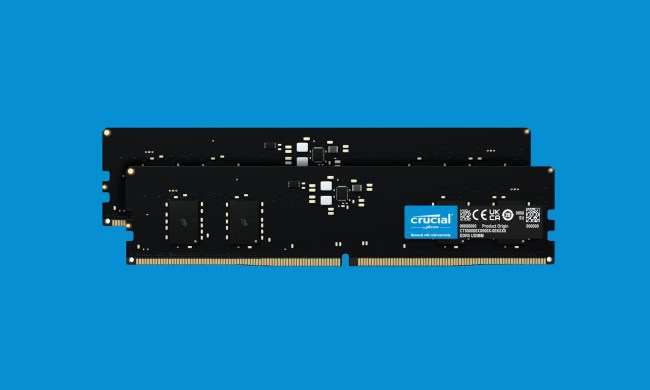

Report: High RAM prices will continue to skyrocket

A year later, the HTC Vive XR Elite is still a uniquely versatile VR headset

The RTX 50-series may fix the biggest weakness of its predecessor

Best gaming PC deals: Lenovo Legion, ASUS ROG, Acer Predator

Manor Lords performance guide: best settings, recommended specs, and more

8 AI chatbots you should use instead of ChatGPT

Computing News

Laptops

Computing Reviews

Nvidia

Trending Downloads

Luke Larsen is a Senior Editor at Digital Trends and manages all content covering laptops, monitors, PC hardware, and everything else that plugs into a computer. Luke joined Digital Trends in 2017 as a native Portlander, happy to join a media company that called his city home. His obsession with technology is in observing the ebb and flow of how technological advancement and product design intersects with our day-to-day experience of it. From digging into the minute details to stepping back and seeing the wider trends, Luke revels in telling stories with tech.

Before working at DT, he worked as Tech Editor at Paste Magazine for over four years and has bylines at publications such as IGN and The Oregonian. When he’s not obsessing over what the best laptop is or how Apple can fix the Mac, Luke spends his time playing designer board games, quoting obscure Star Wars lines, and hanging with his family.