- Home

- Music

Music

How to convert WMA to MP3 on Mac, Windows, and Web

What the heck is that WMA file still doing on your PC? Here’s a guide on how to convert your Windows Media Audio files into easy-to-read MP3 tracks.

How to download music from Spotify for offline listening

So you want to download songs, playlists, and podcasts from Spotify for offline listening? We’ll show you how to do it.

What is hi-res audio, and how can you experience it right now?

Hi-res audio has gone from an audiophile novelty to a mainstream attraction, but there's still a bit of a learning curve to master before you can enjoy it.

Best Cyber Monday Deals 2022: Laptops, TVs, AirPods, and more

With Cyber Monday underway, this is your last chance to grab some of the best Cyber Monday deals out there. But hurry, these are sure to sell out fast!

How to add music to your iPhone or iPad

Enjoy your music on the go! Here's how to add your music to an iPhone or iPad, in several ways.

How to find your lost AirPods using the Find My app

Lost an AirPod device? There are ways to find it again with the right services. We'll go through the steps you need to take to locate that Apple earbud fast.

How to convert your vinyl to a digital format

Converting your beloved vinyl records from wax to digital is a great way to preserve them and take them on the go. Here's how to do it.

The best podcasts of 2022

There are hundreds of thousands of podcasts out there for nearly every subject. We’ve compiled a list of the best podcasts, whatever your interests may be.

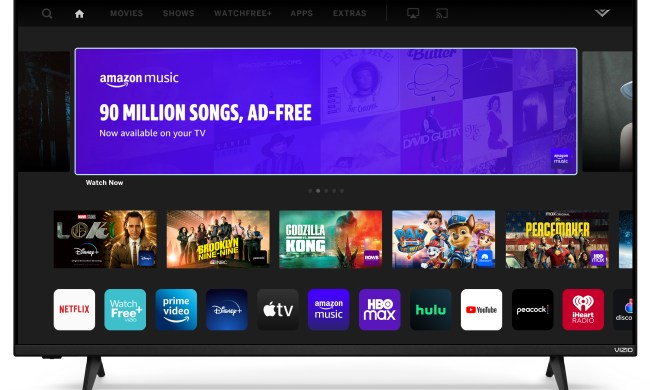

Amazon Music is now available on Vizio TVs

Amazon Music is now available as a native application on Vizio televisions with SmartCast.

Lossless Bluetooth audio? Qualcomm says it’s coming in 2022

Qualcomm's new mobile audio chips will usher in a new wave of wireless audio features like better ANC and audio sharing.

Google Pixel Buds A-Series vs. Apple AirPods 3

Thinking of buying a new set of earbuds? Google's Pixel Buds A-Series and Apple's AirPods 3 are two great choices, but which is the best? Here's what we think.

Jabra Elite 7 Pro vs. Jabra Elite 85t

When it comes to noise-canceling earbuds, Jabra is one of the best brands, bar-none. But can the new Jabra Elite 7 Pro buds top the Elite 85t? Let's find out.

Netflix to shoot pair of Red Notice sequels back-to-back

Ryan Reynolds, Gal Gadot, and Dwayne Johnson are all expected to return for two more Red Notice movies as Netflix prepares an ambitious plan to shoot them.

Spotify’s HiFi tier was MIA in 2021. Will 2022 be any different?

It's been almost a year since Spotify announced a lossless, CD-quality music tier. Now that its original timeline has come and gone, is Spotify HiFi dead?

The weirdest tech we spotted at CES 2022

To celebrate all the strange and wonderful things that surface at CES, we've rounded up a modest collection of the weirdest tech we spotted this year

Forget AirPods Pro: Beats Studio Buds are ONLY $120 at Amazon today

If you're considering picking up a pair of earbuds, then you need to check out this deal at Amazon that slashed the price of the Beats Studio Buds by $30.

From movies to music, 2021 was the year of Dolby Atmos

It's taken a while, but Dolby Atmos has cemented itself as the premier surround sound format -- and 2021 was the year it became nearly ubiquitous.

Chill with Spotify for free on Delta Airlines this holiday season

Spotify users can enjoy free access to their streaming music while on select Delta flights for travel between Dec 8, 2021, and Jan 19, 2022.

Watch Spotify’s tour of its plush U.S. headquarters

Spotify has offered curious folks a look inside its newly refurbished -- and very plush -- U.S. headquarters at 4WTC in New York City.

How to stream music to a HomePod with an Android phone

The HomePod can work with Android phones, allowing you to stream music to Apple's smart speaker. Here's exactly what you need, and how to set up the connection.

How to play Apple Music on an Alexa device

Alexa is happy to play Apple Music if you know how to set it up. Here's how to get songs from your Apple device or Apple Music to play on your Alexa device.

Spotify adds a Netflix hub so you can listen to the chilling sounds of Squid Game

Spotify is the place to be if you're a fan of Netflix shows like Squid Game or Outer Banks. A dedicated hub has access to official soundtracks and playlists.

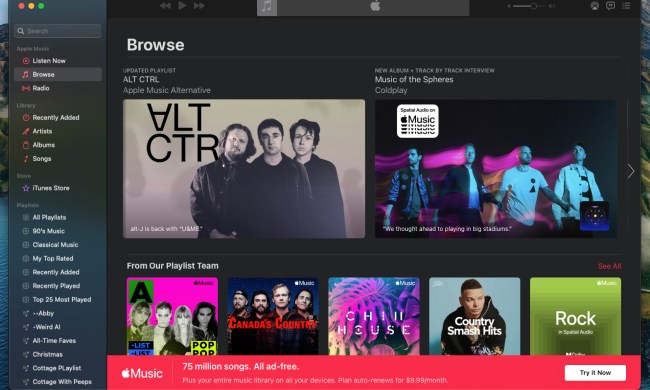

LG’s WebOS TVs get a native Apple Music app

If you've got a WebOS 4.0 TV from LG, you now have access to the full Apple Music app.