- Home

- Gaming

Gaming

About

The latest video game reviews, game trailers, and news, including PlayStation, Xbox, Nintendo Switch, PC, phone and more

PlayStation reverses course on controversial Helldivers 2 PC change

Helldivers 2 will not require PC players to create a PlayStation Network account, Sony has confirmed. The reversal comes after plans to do so angered players.

The best games on PlayStation Plus, Extra, and Premium

To get the most bang for your buck, here are the best games to play on PS Plus Essential, Extra, and Premium.

Helldivers 2 PC players are furious over this controversial change

Helldivers 2 will require PC players to link their PlayStation Network accounts soon, and players are furious about it.

3 retro classics to play on Nintendo Switch Online this weekend (May 3-5)

These Switch Online games are perfect companions to recent releases like Stellar Blade, Endless Ocean: Luminous, and Tales of Kenzera: Zau.

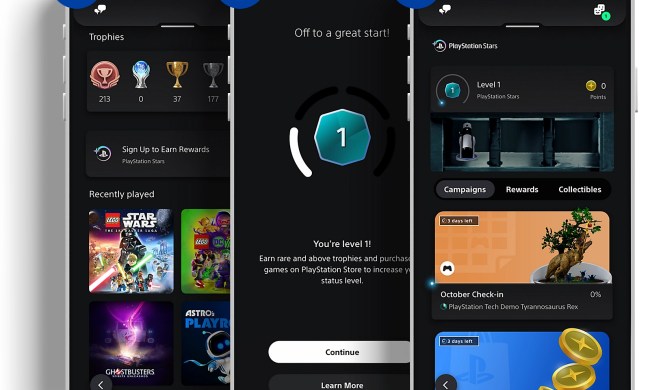

If you’re not using PlayStation Stars, you’re missing out

The PlayStation Stars program still isn't perfect two years later, but it's a hidden gem that all players should take advantage of.

From Our Partners

Presented By Anker Soundcore

3 underrated PS Plus games you should play this weekend (May 3-5)

If you're a PlayStation Plus Premium or Extra subscriber looking for something to play this weekend, check out these games from EA, Sabotage, and LucasArts.

3 Xbox Game Pass games you need to play this weekend (May 3-5)

If you're looking to dig into Xbox Game Pass' catalog this weekend, give these three games a try.

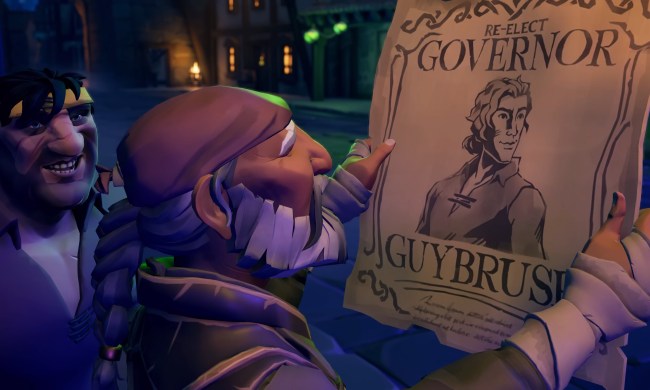

How to get to Monkey Island in Sea of Thieves

Getting to Monkey Island in Sea of Thieves can feel just as difficult as the classic puzzles. Let us walk you through this tall tale to help you get your prize.

Indiana Jones and the Great Circle: release date window, trailers, gameplay, and more

Everyone's favorite part-time archeologist is getting the video game adaptation he deserves with Indiana Jones and the Great Circle. Here is everything we know.

The HP Victus gaming PC with RTX 3060 has a $550 discount

The HP Victus 15L gaming desktop with the Nvidia GeForce RTX 3060 graphics card, with 16GB of RAM is on sale for only $850 following a $550 discount from HP.

The ASUS ROG Ally handheld gaming PC has a nice discount today

The Asus ROG Ally, a handheld gaming PC with the AMD Ryzen Z1 processor and 16GB of RAM, is available from Walmart at $87 off so you'll only have to pay $400.

Is Rust cross-platform?

Just waking up on the Rust island and feeling a little lost? You can play Rust with friends on different platforms, but the title isn't entirely cross-platform.

Sony PlayStation 5 review: slimmer model makes a great console better

The PS5's slimmer upgraded model makes a great console even better, with more storage and a slightly less awkward design.

GTA 6: release date speculation, trailer, gameplay, and more

GTA 6 finally got its first trailer in December 2023. Here's what we know about the next Grand Theft Auto right now based on leaks and rumors from experts.

How well do you know video games? This free game will test your knowledge

Do you know how long it takes to beat your favorite video games? This free browser game will put your knowledge to the test.

The best VR games

Whichever brand of VR headset you own, you have many different choices when it comes to games. These are the best virtual reality games you can play today.

Call of Duty competitor XDefiant is finally coming out this month

XDefiant, Ubisoft's crossover competitive shooter meant to take on the likes of Call of Duty, will finally launch later this month.

The best accessories to use with Delta game emulator

Delta is a nearly flawless emulator for your iPhone, but your phone itself isn't a flawless platform. Use these best accessories to make Delta shine.

What’s free on the Epic Games Store right now?

Did you know that you can snag a free game every week on the Epic Games Store? Here's what games are up for grabs this week.

11 best graphics cards of 2024: the GPUs I’d recommend to any PC gamer

We've reviewed every graphics card from Nvidia, AMD, and Intel. Here are the best GPUs you can buy for your next gaming PC.

Best Samsung monitor deals: 4K monitors, ultrawide, and more

There's an amazing selection of Samsung monitor on sale, and we've rounded up all of the best Samsung monitor deals right here.

I’m thrilled about Batman: Arkham’s move to VR — and you should be too

Batman: Arkham Shadow might not be the game fans wanted, but the VR exclusive has serious potential.

Best gaming laptop deals: Alienware, Razer, Asus and more

With plenty of gaming laptop deals around, we've highlighted some of the best from Alienware, Lenovo, HP, and many more great laptop manufacturers.

Gaming News

Gaming Guides

Nintendo

Action Games

Trending Downloads

Section Editor, Gaming

Giovanni is a writer and video producer focusing on happenings in the video game industry. He has contributed stories to Inverse, Fanbyte, The Inventory, and more. He was previously a segment producer on Polygon’s daily gaming show Speedrun and he currently hosts the Left Trigger Right Trigger podcast. Four Tetris 99 wins, and counting.